2021-22 Federal Budget

By Colin Lewis, Head of Strategic Advice

May, 2021

This is a GOOD NEWS BUDGET as it relates to financial planning advice. The measures announced in this year’s Budget covering taxation, superannuation and social services are all positive and, I’m sure you’ll agree, most welcome – some more so than others.

Taxation

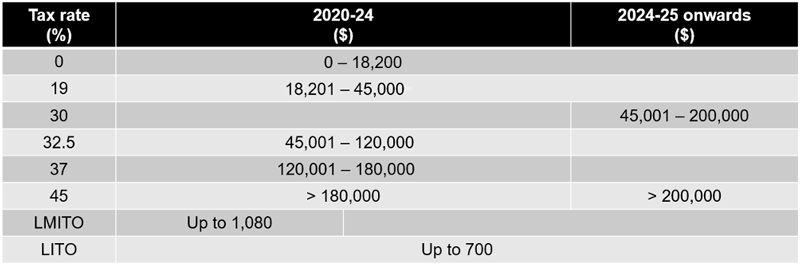

Personal Income Tax

The Government is retaining the low and middle income tax offset (LMITO) for another year – it will continue in 2021-22.

The LMITO provides a reduction in tax of up to $1,080 for individuals (or $2,160 for dual income couples).

When Stage 3 of the Government’s Personal Income Tax Plan is implemented in 2024-25, around 95 percent of taxpayers will face a marginal tax rate of 30 per cent or less.

Extending tax support for business

The Government is extending the two tax incentives announced in last year’s Budget by one year — temporary full expensing and temporary loss carry-back. Together, they create a strong incentive for businesses to bring forward investment to access the tax benefits before they expire.

Temporary full expensing

Temporary full expensing will now be available until 30 June 2023.

It allows eligible businesses with aggregated annual turnover or total income of up to $5 billion to deduct the full cost of eligible depreciable assets – which must be first used or installed ready for use by 30 June 2023.

The 12-month extension will provide eligible businesses with more time to access the incentive, including projects that require longer planning times and those affected by COVID-19 related supply disruptions.

All other elements of temporary full expensing will remain unchanged, including the alternative eligibility test based on total income and a track-record of investment, which will continue to be available to businesses.

Temporary loss carry-back

Temporary loss carry-back will also be extended by one year.

This will allow eligible companies to carry-back tax losses from the 2022-23 income year to offset previously taxed profits as far back as the 2018-19 income year.

Companies with aggregated annual turnover of up to $5 billion can apply tax losses incurred during the 2019-20, 2020-21, 2021-22 and now the 2022-23 income years to offset tax paid in 2018-19 or later years.

The tax refund will be available to companies when they lodge their 2020-21, 2021-22 and now 2022-23 tax returns.

This will help increase cash flow for businesses in future years and support companies that were profitable and paying tax but find themselves in a loss position as a result of the COVID-19 pandemic.

Employee Share Schemes

The Government is removing the cessation of employment taxing point for tax-deferred Employee Share Schemes (ESS) – available for all companies.

By removing the cessation of employment taxing point, tax will be deferred until the earliest of the remaining taxing points:

- for shares, when there is no risk of forfeiture and no restrictions on disposal,

- for options, when the employee exercises the option and there is no risk of forfeiting the resulting share and no restrictions on disposal,

- the maximum period of deferral of 15 years.

The change to the cessation of employment taxing point will apply to ESS interests issued on or after 1 July following Royal Assent.

The Government is also making regulatory improvements to the ESS regime by reducing ‘red tape’.

Modernising the individual tax residency rules

The Government will replace the individual tax residency rules with a new framework that is easy to understand, provides certainty and reduces compliance costs for globally mobile individuals and their employers.

The primary test will simply be:

‘a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident’.

People who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria.

Currently, individuals (and their employers) can face large compliance costs, including the need to seek third-party advice, despite having otherwise simple tax affairs. The new framework is designed to strike the right balance between certainty, simplicity and integrity.

These changes will apply from 1 July following Royal Assent.

Superannuation

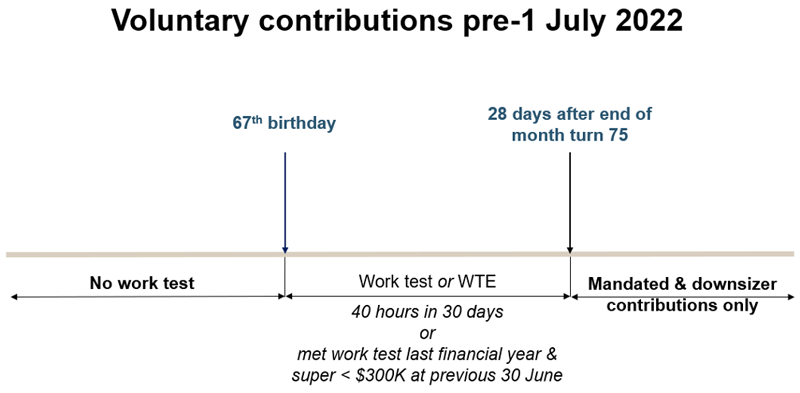

Repealing the work test

‘Simple Super’ is finally getting a little less complex.

The Government will amend the work test rules to allow retirees who have not had the benefit of compulsory superannuation throughout their working lives to get more out of the superannuation system.

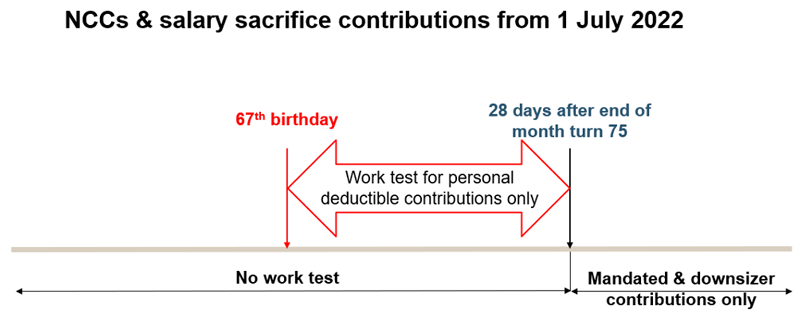

From 1 July 2022, people aged 67 to 74 will no longer be required to meet the work test when making, or receiving, non-concessional contributions (NCCs) or salary sacrifice contributions.

In addition, these people will be able to access the NCC bring-forward arrangement, subject to meeting the relevant eligibility criteria.

However, people aged 67 to 74 wishing to make personal deductible contributions will still need to meet the work test.

A super fund trustee cannot accept a member contribution after 28 days after the end of the month in which they turn 75. Only employer mandated award and Superannuation Guarantee (SG) contributions can be made.

Note that the work test and age restriction do not apply to downsizer contributions – i.e. a contribution from the proceeds of selling a home.

Source: Fitzpatricks Private Wealth

Source: Fitzpatricks Private Wealth

Extending access to downsizer contributions

From 1 July 2022, the minimum age for the downsizer contribution will be lowered from 65 to 60.

This will allow people nearing retirement to make a one-off after-tax contribution of up to $300,000 per person ($600,000 per couple) when they sell their principal place of residence which has been held for a minimum of 10 years.

A downsizer contribution will be able to be made by anyone aged 60 or more.

Downsizer contributions are not treated as NCCs and thus do not count towards the NCCs cap and are not subject to the total super balance (TSB) test. However, the contribution will be included in a person’s TSB which may impact their ability to make NCCs in future years.

In so many ways this government initiative benefits the wealthy. They are the ones most likely to use the opportunity to make a downsizer contribution to their advantage.

Self-managed superannuation funds — relaxing residency requirements

The Government will relax residency requirements for self-managed superannuation funds (SMSFs) and small APRA-regulated funds (SAFs) by:

- extending the central control and management test safe harbour from two to five years for SMSFs.

- removing the active member test for both SMSFs and SAFs.

This measure will allow SMSF and SAF members to continue to contribute to their super fund whilst temporarily overseas, ensuring parity with members of large APRA-regulated funds. This will provide SMSF and SAF members the flexibility to keep and continue to contribute to their preferred fund while undertaking overseas work and education opportunities.

The measure will have effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

Legacy product conversions – finally!

The Government will allow people who are locked in certain income streams – which restrict access to capital and flexibility of drawdowns – to finally get out of them, but the opportunity to do this will only be temporary.

A two-year period will be provided for the conversion of market-linked income streams – i.e. term allocated pensions (TAP) and annuities – and complying lifetime and life-expectancy pension and annuities.

Retirees currently ‘trapped’ in these income streams may choose to completely exit these income streams by fully commuting them and transferring the underlying capital, including any reserves, back to accumulation phase. From there they can commence a new income stream, withdraw a lump sum benefit, or retain the funds in the accumulation account.

Importantly, any associated reserve transferred to accumulation phase will not count towards the member’s concessional contributions (CCs) cap and thus will not result in excess CCs. Instead, the transferred reserve will be treated as an assessable contribution of the fund and taxed at 15 percent – recognising the prior concessional tax treatment received when the reserve was established to pay the pension.

The existing social security treatment applying to these income streams will not transition over for those who elect to take advantage of the conversion but exiting an income stream will not cause re-assessment of the social security treatment of the income stream for the period before conversion.

Existing rules for income streams will continue to apply. So, people starting a new retirement phase income stream will be limited by their transfer balance cap (TBC). The existing TBC valuation methods for the legacy income stream, including on commencement and commutation, continue to apply.

Timing

Exits will be possible for two years commencing from the beginning of the first financial year after Royal Assent of the enabling legislation.

The following (edited) examples come from the Government’s Budget 2021-22 Superannuation Fact Sheet.

Example 1: Allowing access to reserves

Jill is 80 years old and has a lifetime pension in her SMSF. The lifetime pension – which commenced in 2003 – has set annual payments and a reserve which supports the pension. Jill thinks this pension no longer suits her needs as she wants to be able to access her capital as required. Jill commutes the pension including the reserve back to accumulation phase before commencing an account-based pension (ABP) with all the proceeds. The reserves transferred back to accumulation phase are included in the fund’s assessable income and taxed at 15 percent. Jill has space in her TBC to commence a new ABP. As the ABP counts towards the Age Pension assets test, Jill’s part Age Pension payment rate will be re-assessed. She now has immediate access to all the capital that was previously supporting the lifetime pension and more flexibility in how she draws down her superannuation.

Example 2: Interactions with the transfer balance cap

Mark is 75 years old and has a market-linked pension that first commenced in 2005. He commutes the TAP back to accumulation phase before commencing an ABP with some of the proceeds. However, Mark cannot move all the proceeds into an ABP because he does not have enough space in his TBC. Mark retains the rest of the proceeds in an accumulation account where earnings are taxed at 15 per cent. Mark decided the conversion is worthwhile to gain extra flexibility in accessing his superannuation. He will continue to receive a part Age Pension which will remain relatively unchanged.

Example 3: Social security treatment

Roberta is a 70-year-old single retiree who has a life-expectancy pension, with no reserve, that first commenced in 2007. Roberta commutes the pension back to accumulation phase in an APRA-regulated fund. She then commences an ABP with the full balance as she has sufficient space under her TBC. Roberta was primarily exiting to give herself the option to access the monies as tax-free lump-sum benefits should she need to do so. Her Age Pension payments also increase because of the conversion. This is because Roberta’s Age Pension is being set by the income test and the deemed income on her new ABP is lower than the income from her former life-expectancy pension.

Removing the $450 per month threshold for Superannuation Guarantee eligibility

The Government will remove the current $450 per month minimum income threshold, under which employers are not required to make SG payments for employees.

The measure will have effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

This measure will improve equity in the superannuation system by expanding the SG coverage for those on lower incomes. The Retirement Income Review estimated that around 300,000 individuals would receive additional SG payments each month – 63 percent of whom are women.

First Home Super Saver Scheme — increasing the maximum releasable amount

The Government will increase the maximum releasable amount of voluntary CCs and NCCs under the First Home Super Saver Scheme (FHSSS) from $30,000 to $50,000.

Voluntary contributions made from 1 July 2017 up to the existing limit of $15,000 per year will count towards the total amount able to be released.

The increase in maximum releasable amount will apply from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects will have occurred by 1 July 2022.

This measure will ensure the FHSSS continues to help first home buyers in raising a deposit more quickly.

In addition, the Government will make four ‘technical’ changes to the legislation underpinning the FHSSS to improve its operation as well as the experience of first home buyers using the scheme who make errors on their FHSSS release applications.

Social Services

Improving the Pension Loans Scheme

The Government is increasing the flexibility and attractiveness of the Pension Loans Scheme (PLS).

From 1 July 2022, the Government will introduce a No Negative Equity Guarantee for PLS loans and allow people access to a capped advance payment in the form of a lump sum.

No Negative Equity Guarantee

This guarantee will mean that borrowers under the PLS, or their estate, will not owe more than the market value of their property – in the rare circumstances where their accrued PLS debt exceeds their property value.

This brings the PLS in line with private sector reverse mortgages.

Immediate access to lump sums

Eligible people will be able to receive a maximum lump sum advance payment equal to 50 percent of the maximum Age Pension. Based on current Age Pension rates, this is $12,385 per year for singles, while couples combined could receive $18,670. A maximum of two advances totalling up to the cap amount are permitted in a year – for those who do not want to take an advance in one instalment.

Background

The PLS is a voluntary, reverse mortgage type loan available to assist older Australians who wish to boost their retirement income by unlocking equity in their real estate assets.

Through the PLS, people can receive additional regular fortnightly payments with the payments accruing as a debt secured against their Australian property.

The PLS allows a fortnightly loan of up to 150 percent of the maximum rate of Age Pension. An interest rate (currently 4.5 percent) is charged.

PLS and age pensioners

Under the existing PLS, those on a full-rate Age Pension can get an annual income boost worth 50 percent of a full Age Pension representing $12,385 per year for singles and $18,670 for couples. This is on top of receiving a full Age Pension.

The increased flexibility from 1 July 2022 will allow a full-rate age pensioner to access their entire annual PLS amount as a lump sum. This is on top of receiving a full-rate Age Pension.

Those on a part-rate Age Pension will also be able to access a lump sum worth 50 percent of a full Age Pension. They will continue to be able to use the PLS to top-up their fortnightly pension through the PLS, such that their combined Age Pension plus PLS benefit (both lump sums and income stream) is up to 1.5 times a full-rate Age Pension payment.

PLS and self-funded retirees

Under the existing PLS, self-funded retirees of Age Pension age who do not receive any Age Pension can get an income boost over a year worth 1.5 times a full rate Age Pension payment. This represents $37,155 per year for singles and $56,011 per year for couples.

The increased flexibility from 1 July 2022 will allow a self-funded retiree to get a lump sum payment worth up to 50 percent of a full rate Age Pension, representing $12,385 per year for singles and $18,670 for couples under the PLS each year.

This is on top of the other amounts they may receive under the PLS up to the maximum annual amount and means they will be able to bring-forward one third of their maximum PLS payments if they choose to do so.

Housing

The Government aims to increase home ownership and support jobs in the residential construction sector with the following measures.

- Extending the construction commencement requirement from six months to 18 months for all existing applicants under the HomeBuilder program.

- Establishing the Family Home Guarantee with 10,000 places from 2021-22 to support single parents with dependants to enter, or re-enter, the housing market with a deposit of as little as 2 percent.

- Extending the First Home Loan Deposit Scheme to provide an additional 10,000 New Home Guarantees in 2021-22 to allow eligible first home buyers to build a new home or purchase a newly constructed home sooner with a deposit of as little as 5 percent.

Aged care

The Government will release 80,000 additional home care packages across all package levels – which will bring the total number of home care packages to 275,598 by June 2023.

This measure is designed to support older Australians requiring formal aged care to stay in their home longer before having to take the next step of moving into residential aged care.

And I couldn’t sign off without mentioning the tax relief for brewers and distillers – great news for lovers of craft beer, gin and whisky!