11 key findings on retirement dreams during the pandemic

By Matt Rady, on behalf of Firstlinks

November 2020

COVID-19 is taking a harsh toll on the economic wellbeing of many retirees with research showing it has shaken their confidence in the quality of their retirement and how long their money will last. Notwithstanding the recovery in many share prices over recent months, returns on cash and term deposits are negligible.

Here are 11 key findings from the Allianz Retire+ research during the pandemic, conducted a few months ago.

1. Money is a recurring worry for retirees

Almost one in four retirees (24% of survey respondents) said they worried about making ends meet. One in five (20%) said money was a constant worry.

2. Spending even less on necessities, luxuries

Three quarters (75%) of surveyed retirees said they were spending less on luxuries due to COVID-19. Two thirds (68%) of retirees said they were only buying necessities.

3. Many retirees did not feel financially secure

Half (51%) of surveyed retirees said they did not feel secure in their financial position.

4. Wealth destruction

A third (36%) of surveyed retirees said they had lost money during the COVID-19 market downturn. One in 10 (13%) believed they had experienced financial losses that would not be recovered during their retirement.

5. Vulnerable to another financial shock

Almost two-thirds of respondents (61%) did not believe their financial situation was safe in the event of another economic downturn.

6. Lack of control

Just under half of surveyed retirees (45%) did not feel in control of their financial future. Higher sharemarket volatility was making many retirees feel they were at the mercy of global financial markets and unable to control their financial future.

7. Quality of life worries

Recurring worries about day-to-day bills, financial security and the risk of another economic shock was fuelling concerns about life quality in retirement. A third (34%) of retirees said they worried about whether their finances would allow them to have a good quality of life.

8. Illness, market uncertainty top concerns

The top five retiree concerns were:

- becoming ill (55%)

- unexpected costs (45%)

- losing a loved one (44%)

- not having enough money to live the life they wanted in retirement (34%)

- the risk of one-off market downturns such as COVID-19 and the GFC (32%).

9. More conservative approach

Almost two-thirds (62%) of surveyed retirees said they were taking a more conservative approach to their retirement because of COVID-19. Given that many retirees already live conservatively, the finding added to the broader survey theme of retirees cutting back even further and taking fewer financial risks during the pandemic.

10. Retirement expectations being downgraded

Almost a quarter of current retirees (23%) now had more negative expectations of their retirement due to COVID-19.

11. Wary of financial advice

Less than a quarter (23%) of surveyed respondents sought financial advice, even though they were feeling less financially secure. Allianz Retire+ research consistently finds that retirees who used professional investment advice feel more confident in their financial position.

Here is more detail on the research:

Shortcomings in retirement outcomes

Many Australian retirees are downgrading their retirement expectations, spending less on luxuries, and are fearful and confused about the safety of their investments.

The Allianz Retire+ survey collated the views of over 1,000 current and prospective retirees nationwide in May 2020, to understand how COVID-19 was affecting their lifestyle, investment actions and retirement perceptions.

Only one-third of retirees feel confident in their financial position. In addition to health concerns about the virus and not being able to see family and friends as much, retirees are yet again suffering the sharemarket rollercoaster.

A total of 66% do not agree that Australia’s superannuation system will provide them with a dignified retirement. It suggests the Australian superannuation system, which is lauded as one of the best globally, is not working for a great deal of the people it’s designed for.

Moreover, COVID-19’s impact has exposed systemic issues in the drawdown phase of retirement, highlighting shortcomings in retirement product design, access to financial advice and superannuation education.

In a previous study, ‘The Next Chapter’ undertaken by Allianz Retire+ in 2019, retirees reported feeling nervous and uncertain about what’s ahead and lacked in investing confidence. Unfortunately, COVID-19 has taken that to a new level. On both occasions the research indicated retirees want safe, simple, low-cost retirement products with certainty a key feature. Unfortunately, the investment industry is not generally meeting that need.

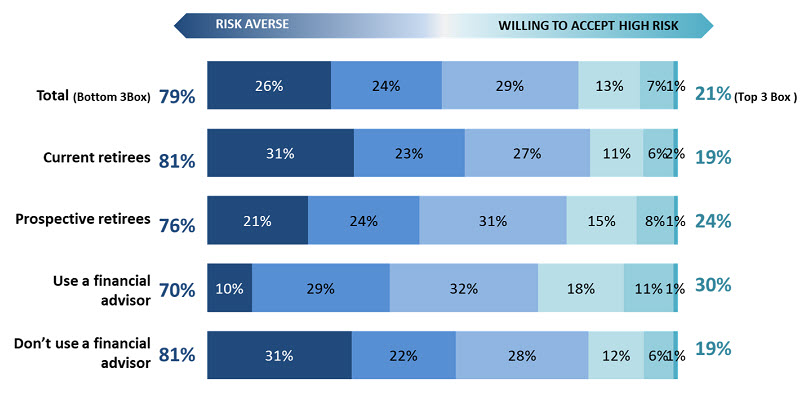

The current survey found that three in four retirees are not confident about how long their money will last in retirement and when asked about their investments during the pandemic, only 18% felt their investments would be safe in case of economic downturn. They also reported being largely risk averse, seemingly exacerbated by the pandemic.

Source: Allianz Retire+, ‘Black Swan Research’, May 2020

Nearly half of respondents said they were monitoring their investments much closer due to COVID-19 and just under a third of those surveyed were happy with the federal government’s response to COVID-19 policies that affect their retirement.

The pandemic has brought many of the systemic issues back to the surface and there needs to be a greater sense of urgency in delivering change to the system.

Prospective retirees most at risk

The economic impact of COVID-19 was greater on prospective retirees (within seven years to retirement) than current retirees, the survey found.

Source: Allianz Retire+, ‘Black Swan Research’, May 2020

Vulnerability close to retirement

About 40% of prospective retirees said they lost money to date during COVID-19. Just over one in five said their employment status has (or may) change due to the economic downturn.

Falling retirement savings and rising job insecurity is a toxic combination. Around one in three prospective retirees now have more negative expectations of their retirement. And 77% of prospective retirees do not believe superannuation will provide them with enough money in retirement.

Those nearing retirement have been particularly hurt by the downturn. These investors tend to have more funds allocated to shares, so have higher susceptibility to market crashes. Typically, they are still working and need that income to build retirement savings.

This is where the impact of COVID-19 has shown the danger of ‘sequencing risk’, where the timing of poor market returns can permanently damage retirement savings. Prospective retiree investors can ill afford to have the share component of their superannuation crushed by market volatility. Many do not have enough time left in the workforce to rebuild their wealth.

With COVID-19 reinforcing the need for retirement-savings products that have a low-cost protection mechanism, around one in three prospective retirees said they would consider an investment product that ‘insured them from market downturns’. Investing in retirement is very different to accumulation and retirees are realising diversification and asset allocation is no panacea to protect wealth during crises.

Lack of advice during the pandemic

Remarkably, the survey found 79% of retirees did not seek financial advice during COVID-19.

Only one in five retirees felt that they had easy access to professional financial advice and approximately a third felt financial advisers were ‘for the rich’. Almost two-thirds of those without an adviser said they would not use one because the service was too costly.

The advice proposition is proven to be an integral part of providing individuals with confidence and certainty in retirement, with those who use an adviser stating more confidence and security in their financial position. And 68% of those who were advised during COVID-19 said they are sticking to their financial plan, meaning advice is definitely deterring people from making sub-optimal investment decisions based on fear or a lack of understanding. That fact alone proves there is a clear need to change the perception of financial advice among retirees and increase access to affordable advice.

About the survey

Allianz Retire+ commissioned research surveying 1,007 retirees in May 2020 to understand how the economic impact of COVID-19 was affecting them. The sample was split equally between current and prospective (retiring in the next seven years) retirees, and equally between men and women. Most respondents were aged 60 to 75 or over. The survey included responses from retirees in each State and Territory. About two thirds of respondents had an annual household income below $79,000.