According to CoreLogic, Australian house prices increased +22.1% in 2021, led by Australia’s largest city of Sydney (+25.3%). There are a few culprits behind this stellar performance, including record low interest rates, healthy household balance sheets and a desire to re-invest in the home as some workers contemplate an extended ‘work from home’ environment.

The uplift in residential prices is not a local event. The value of homes has soared across the world, including New Zealand (+27.6%), the United States (+19.1% to October), the UK (+10.0%) and even places like Turkey (+40.0% to October). And for those who believe interest rates drive property prices, the average key interest rate in Turkey during 2021 was 18%, up from 11% in 2020.

As we head into 2022, there is an expectation that interest rates will rise around the world in response to recent inflation data. That may be true, but we do not believe this will be enough in itself to stop the gains. In fact, rising rates may add to further gains, as per Turkey.

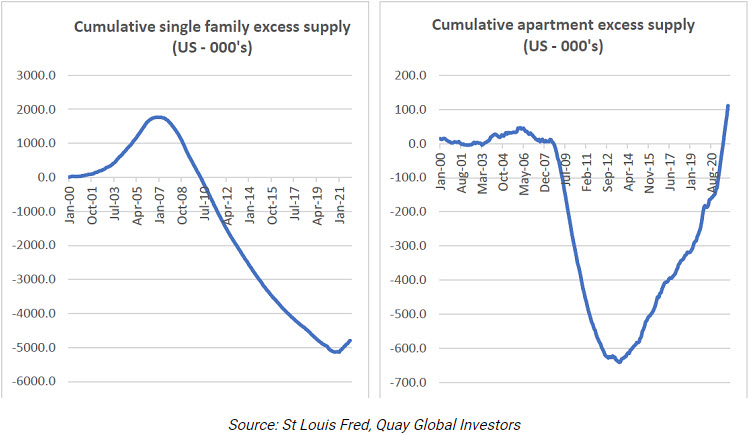

The biggest risk for investing in residential property is, as always, excess supply.

The housing cycle

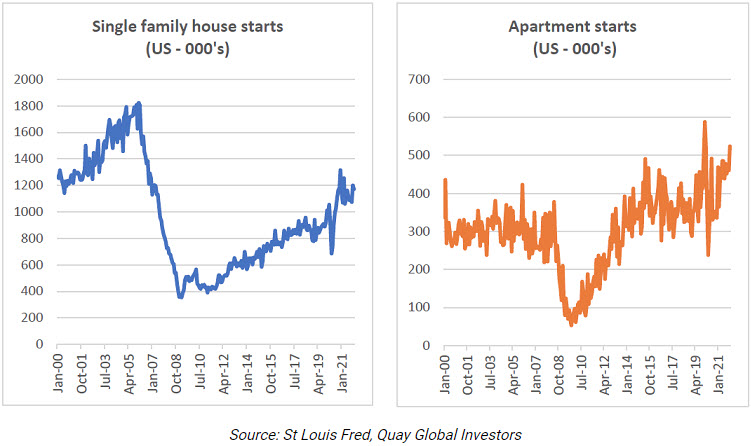

While there are many theories as to what drives house prices, ranging from interest rates and lenient tax rules to immigration, residential property prices ultimately mean-revert around replacement cost. As prices increase above the ‘cost to build’ there is almost always a supply response, as developers try to cash in on the margin. Ultimately, increasing supply dampens prices back to a level where supply is restricted and the cycle starts all over again.

So, is the surge in residential property prices causing a supply response? In Australia, the answer is an emphatic yes.

, where we reversed our earlier bearish 2017 call.

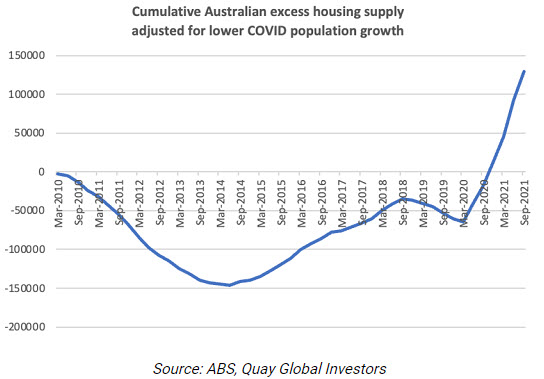

However, with COVID, population growth effectively halted right at the time supply was accelerating. For example, if we were to reduce our household growth assumption to 20,000 per quarter (60% reduction), the residential market would quickly become oversupplied (once current projects complete later in 2022).