By Colin Lewis, Head of Strategic Advice, Fitzpatricks Advice Partners

December 2025

Australians love property but getting onto the property ladder is so hard these days, especially for young adults.

Many parents act as the Bank of Mum and Dad in helping their kids buy their first property via a loan, gift, going guarantor or even becoming a co-owner.

Now, the federal government is stepping up support with the launch of its long-awaited Help to Buy Scheme – first proposed back in 2022.

The scheme starts for most states and territories from today, December 5, but Western Australia and Tasmania are yet to pass the legislation to participate in it.

The federal government already offers the Home Guarantee Scheme (includes three types of Guarantees) supporting Australians to buy a home sooner, and the First Home Super Saver Scheme helping people to boost their super savings for a first home by building a deposit inside the concessionally taxed superannuation system.

The Help to Buy Scheme is different.

This scheme is a shared equity scheme whereby the federal government makes a potentially substantial contribution towards a buyer’s property purchase in exchange for a share in the property – that is, it will hold ownership over an equivalent portion of the buyer’s home.

The size of the government’s equity contribution varies.

It’s up to 30 per cent for an existing home and up to 40 per cent for a new home.

The intention is to make it easier for low to middle-income earners to buy property – potentially helping young adult children get into their first home.

Eligibility criteria

You must be an Australian citizen at least 18 years of age and earn less than $100,000 per year if you’re single, or less than $160,000 per year for couples. These (higher) income caps, along with higher property price caps, were unveiled in the Federal Budget on March 25.

You must live in the property, so this scheme is not for those looking to buy an investment property, and you cannot own any other land or property in Australia or overseas – it’s restricted to people that don’t already own a home.

You must have a deposit of at least two per cent of the property’s value and be approved for a home loan to finance the remaining portion of your share of the equity.

Whilst a two per cent deposit may sound attractive, the reality of it may be entirely different in terms of risk and mortgage affordability.

Finally, you must be able to manage all upfront costs including stamp duty, if payable, legal feels and bank fees.

You will also be responsible for ongoing costs associated with the property such as rates, strata and electricity bills.

Property price caps by region

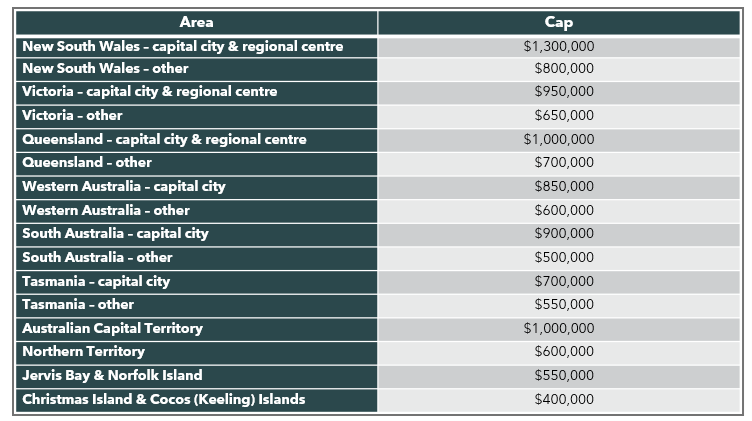

Houses, townhouses and units will all be eligible under the scheme, but buyers will be restricted by the value of the property’s purchase based on location.

Buyers in Sydney and other New South Wales-based regional centres can look at properties worth up to $1.3 million, albeit unobtainable on the bare minimum deposit.

The cap is set at $1 million in Brisbane and Canberra, $950,000 in Melbourne, $900,000 in Adelaide, $850,000 in Perth, $700,000 in Hobart and $600,000 in Darwin.

Advantages

A low deposit – just two per cent genuine savings.

Despite only needing a small deposit, you will not pay lender’s mortgage insurance – usually required if a home loan is more than 80 per cent of the property’s purchase price – as the government’s contribution will be up to 40 per cent of the purchase price.

Having no lender’s mortgage insurance is a huge saving – reducing upfront costs.

Lenders are likely to consider the federal government as a secure partner, making it easier to get approved for a mortgage.

You may also benefit from smaller mortgage repayments.

There’s no requirement to pay rent on the portion of the home owned by the government – another huge saving.

And there’s the opportunity to repay the government’s share in increments of 5 per cent after two years.

Government getting its money back …

The government’s equity contribution will be either paid down over time – you buy back some or all of government’s stake if and when you’re able to – or repaid when the property is sold.

The government’s stake remains unchanged even if the property’s value changes.

Say you purchase a property worth $800k with $160,000 from the scheme – the government owns 20 per cent.

You sell the property for $900,000.

If you haven’t bought out any of the government’s equity, its 20 per cent stake will have increased to $180,000 which must be repaid.

But if the property’s value drops to $750,000, the government’s stake will only be worth $150,000.

Drawbacks

The scheme has limited availability – only 10,000 places per year, capped at 40,000 over 4 years.

The government has the power to veto purchases – certain purchases may be denied based on factors including growth potential and safety.

Income reassessments – the government will look at your income every year and if it improves you may be required you to buy back its share of the property.

If the scheme is terminated or the government otherwise ends its arrangement with you, you’ll have just 90 days to repay its share, which isn’t long. This limitation is something to consider as it may mean selling at short notice if you cannot buyout the government.

Some may ask why you’d want the government to own part of your home, but this new scheme has a lot of appeal.

It may help you enter the property market sooner with a smaller deposit, upfront savings from no lender’s mortgage insurance and the ability to secure a smaller loan.

Alternatively, the government’s equity will boost your buying power – helping you to purchase a bigger and more expensive home or a home in a better area offering the greater capital growth potential.