As Microsoft founder Bill Gates has noted, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.”

Join us on a journey to 2030, as we imagine the change that will take place over the next decade in the investment landscape. To get there, we asked three Capital Group investment professionals to offer their perspectives on the themes shaping the future for investors.

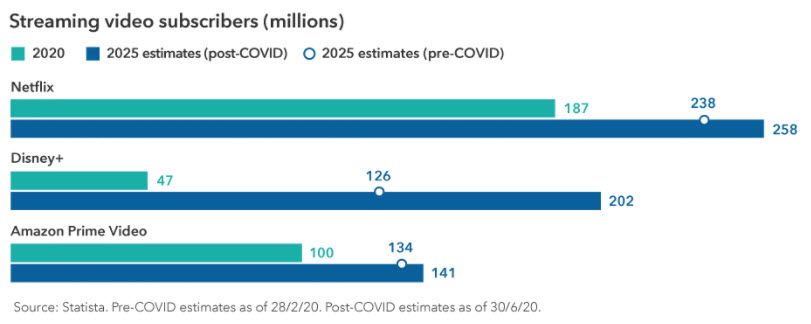

1. The big will keep getting bigger

When it comes to market share in the digital era, size matters. It’s a theme affecting many industries but is perhaps most obvious in online advertising where Google (Alphabet) and Facebook control 37% of the market. This is in sharp contrast to the fragmented days of 2007, when the top two competitors combined for just 4%. “Because of their size, they are driving the best returns for advertisers. They are growing by driving more usage and showing more relevant ads, not by raising prices,” says equity analyst Brad Barrett, who has been covering media and internet companies for 19 years.

This is another case where the big get bigger and the well-entrenched—such as Amazon’s AWS and Microsoft’s Azure—are likely to maintain staying power. The barriers to entry, switching costs and the ecosystem effects are significant, making it tough for new players to reach competitive scale. But service providers won’t be the only winners from surging cloud demand. Vendors who supply equipment needed to grow data centers, such as central processing units (CPUs), batteries and cooling equipment, should also flourish.

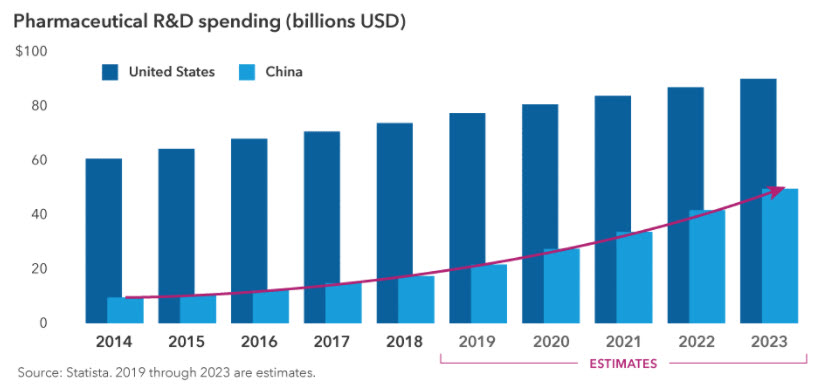

3. Innovative leaders may emerge in emerging markets

If you think the most innovative companies are in the U.S., think again. When it comes to innovation, large U.S. tech companies seem to get most of the attention. But that conversation may shift toward what’s happening in China and other emerging markets, says portfolio manager Chris Thomsen.

“We’re going to see emerging markets companies move from copycats to true innovators,” says Thomsen. “We used to refer to companies like Alibaba as the ‘the Amazon of China’ or Baidu as the ‘Google of China’, but these companies have really developed and localised their technology, while accelerating their growth in ways different from the U.S.”

Thomsen also notes that successful new entrants may scale more quickly than older companies, likely long before they become household names outside of local markets. “Consider Pinduoduo, which is an e-commerce company in China that is less than 10 years old but has already surpassed a $100 billion market cap. Likewise, the US$150 billion multi-service platform, Meituan, has over 450 million active users. There are going to be a lot more of these cropping up across industries.”

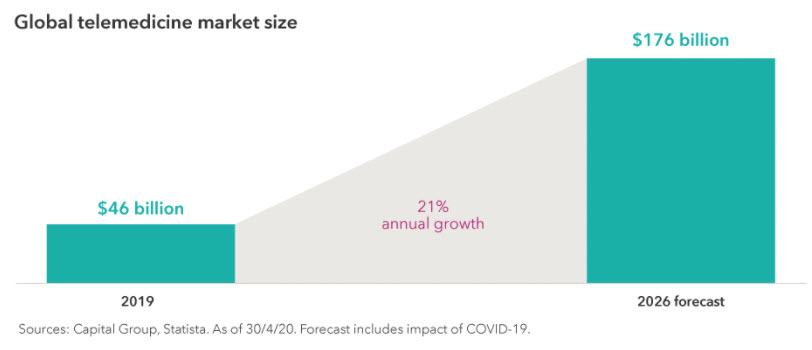

4. The prognosis looks good for a cancer cure

A cure for cancer may be closer than you think. According to Frank, breakthroughs in gene therapy and new applications of artificial intelligence are accelerating drug development. “I believe some cancers will be functionally cured with cell therapy between now and 2030. New, reliable tests will enable very early detection of cancer formation and location. Beyond 2030, cancer could be largely eradicated as a major cause of death through early diagnosis.”