Federal Budget 2018

May 2018

Personal Income Tax

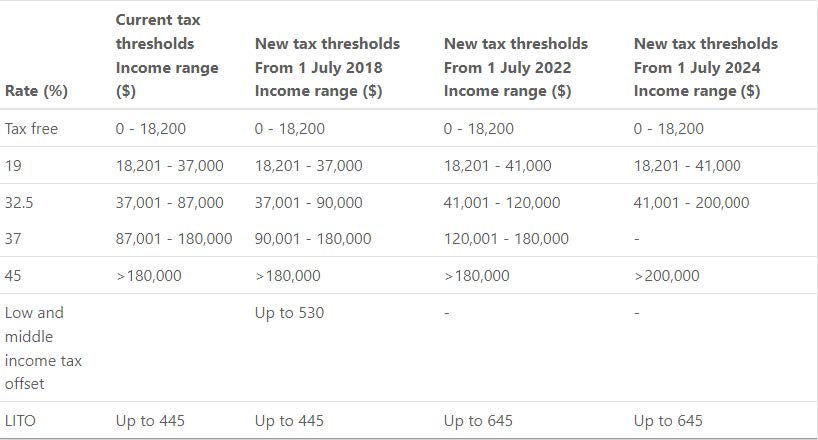

The Government is introducing a seven year Personal Income Tax Plan.

The first step provides permanent tax relief to low and middle-income earners to help with the cost of living pressures.

The second step provides relief from bracket creep by increasing the top threshold of the 32.5 percent personal income tax bracket.

The third step simplifies and flattens the system by removing the 37 percent income tax bracket entirely.

Step 1 – Targeted tax relief for low and middle-income earners

- A Low and Middle Income Tax Offset (LAMITO) will be introduced – a non-refundable tax offset of up to $530 per annum to Australian resident low and middle income taxpayers. It will be available for the 2018/19 to 2021/22 tax years and will be received as a lump sum on assessment after an individual lodges their tax return.

- The LAMITO will provide a benefit of up to $200 for taxpayers with taxable income of $37,000 or less. Between $37,000 and $48,000 the value of the offset will increase at a rate of three cents per dollar to the maximum of $530. Taxpayers with taxable incomes from $48,001 to $90,000 will be eligible for the maximum benefit of $530. From $90,001 to $125,333, the offset will phase out at a rate of 1.5 cents per dollar.

- The LAMITO is in addition to the existing Low Income Tax Offset (LITO).

Step 2 – Protecting middle income earners from bracket creep

- From 1 July 2018, the top threshold of the 32.5 percent personal income tax bracket will increase from $87,000 to $90,000.

- From 1 July 2022, the LITO will increase from $445 to $645 and the top threshold of the 19 percent income tax bracket will increase from $37,000 to $41,000 to lock in the benefits of Step 1.

- The increased LITO will be withdrawn at a rate of 6.5 cents per dollar between incomes of $37,000 and $41,000, and at a rate of 1.5 cents per dollar between incomes of $41,001 and $66,667.

- From 1 July 2022, the top threshold of the 32.5 percent income tax bracket will increase from $90,000 to $120,000.

Step 3 – Ensuring Australians pay less tax by making the system simpler

- From 1 July 2024, the top threshold of the 32.5 percent income tax bracket will increase from $120,000 to $200,000. Thus, taxpayers will pay the top marginal tax rate of 45 percent from taxable incomes exceeding $200,000 and the 32.5 percent tax bracket will apply to taxable incomes of $41,001 to $200,000.

New personal tax rates & thresholds

Source: Budget 2018-19 Fact sheet – Lower, fairer and simpler taxes

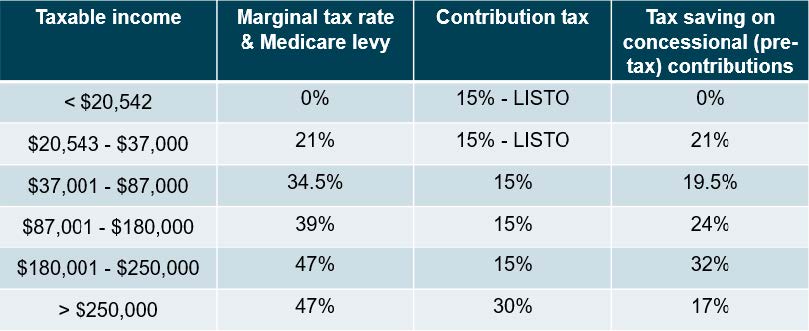

Tax benefit of concessional (pre-tax) super contributions in 2017/18

NB. Taxable income includes LITO. LISTO is the Low Income Superannuation Tax Offset

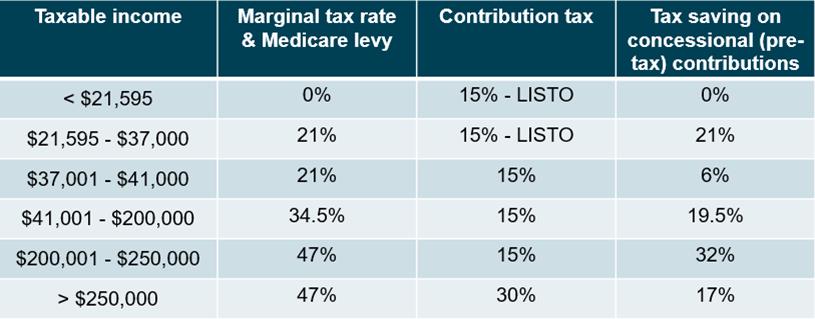

Tax benefit of concessional contributions from 1 July 2024

NB. Taxable income includes LITO. The Budget makes no mention of any change to LISTO. Should it change in line with the top threshold of the 19 percent income tax bracket then the bracket will become $21,595 – $41,000 with a tax saving of 21%.

Removing the 37 percent income tax bracket from 1 July 2024 means that the tax saving of making concessional (pre-tax) contributions for people earning between $87,001 and $180,000 reduces from 24 percent to 19.5 percent.

Pension Work Bonus (Work Bonus)

From 1 July 2019, the Work Bonus will increase to $300 per fortnight, up from $250 per fortnight. This means that the first $300 of income from work each fortnight will not count towards the Age Pension income test.

This is in addition to the income free area which is currently $168 a fortnight for a single pensioner and $300 a fortnight (combined) for a pensioner couple. Thus, a single person with no other income will be able to earn up to $468 a fortnight from work and get the maximum Age Pension.

Pensioners will also continue to accrue unused amounts of the fortnightly Work Bonus which can exempt future earnings from the income test. The maximum accrual amount will increase to $7,800.

For the first time, eligibility for the Work Bonus will extend to earnings from self employment. This means an Age Pensioner can earn $7,800 per year through self-employment without impacting their pension.

To ensure the Work Bonus only applies to actual engagement in gainful work, there will be a ‘personal exertion’ test. It is not intended that the Work Bonus will apply to income associated with returns on financial or real estate investments.

Retirement Incomes

The Treasurer, Scott Morrison, announced two significant changes that may impact retirement planning. They recognise that many senior Australians have most of their wealth tied up in the family home.

Extending the Pension Loans Scheme (PLS)

The PLS is a home equity release scheme offered by the Government which allows retirees to supplement their income. It allows asset rich but cash poor retirees who own their home and are not on the maximum Age Pension to top-up their pension via a loan from the Government.

From 1 July 2019, all retirees of Age Pension age, including maximum rate pensioners and self-funded retirees, will have access to this home equity release to supplement their retirement income. Full-rate pensioners can draw income of up to $11,799 (singles) and $17,787 (couples) per year by unlocking equity in their home.

Also from that date, the maximum allowable combined Age Pension and PLS income stream will increase to 150 percent of the Age Pension rate.

PLS participants can stop or start at any time and repay the loan if they wish, although this usually happens when the home is sold. There are age-based limits on the loan-to-value ratio which means that that PLS holders cannot owe the Government more than what their home is worth. The current borrowing rate is 5.25 percent which is not cheap in the current low interest rate environment.

Income streams from the PLS are non-taxable and not means tested.

Generally, home equity release schemes, commonly known as reverse mortgages, are not popular and are seen as a last resort for senior Australians to raise money. At least the new rules will make the PLS competitive with commercial products.

Retirement income framework

The Government is introducing a ‘retirement income covenant’ requiring super funds to help members achieve retirement income objectives. Trustees must offer a Comprehensive Income Product for Retirement (CIPR) that provides income for life regardless of how long they live. This will be a major boost to providers of products like lifetime annuities.

From 1 July 2019, new Age Pension mean testing rules will apply to pooled lifetime income streams. A fixed 60% of all pooled lifetime product payments will be assessed under the income test and 60% of the purchase price of the product will be assessed under the assets test. These apply until the age of 84, or a minimum of 5 years, and then at 30% for the rest of the person’s life.

Policies bought before 1 July 2019 will be grandfathered.

The Government expects this clarity will pave the way for the development of CIPRs.

Superannuation

With so much change in the superannuation landscape over the past few years, it’s nice to have a reprieve from further major change in this year’s Federal Budget. Everyone can breathe a sigh of relief!

Change to work test – an extra year to contribute

From 1 July 2019, people aged 65 to 74 with a total superannuation balance (TSB) below $300,000 will be able to make voluntary contributions for 12 months from the end of the financial year in which they last met the work test, i.e. voluntary contributions will be permitted in the first year the work test is not met.

Three-year audit cycle for certain self-managed superannuation funds (SMSFs)

From 1 July 2019, the annual audit requirement for SMSFs will change to a three yearly requirement for funds with a history of good record keeping and compliance. This will reduce red tape for SMSF trustees that have a history of three consecutive years of clear audit reports and that have lodged the fund’s annual returns in a timely manner.

Other changes

A number of other very positive superannuation measures where announced in the Budget.

From 1 July 2018, people earning more than $263,157 who have multiple employers, for example medical specialists that work for different hospitals as well as private practices, will be able to nominate that their wages from certain employers are not subject to Superannuation Guarantee. Thus, they will avoid beaching the concessional contributions cap and have the potential to negotiate higher income.

From 1 July 2019, inactive accounts below $6,000 will be transferred to the Australian Taxation Office to protect them from further erosion and data matching will be used to connect with a member’s active accounts.

Total fees on super accounts of less than $6,000 will be capped at 3% and exit fees will be banned on all accounts.

Another positive measure is that life insurance in large super funds will be an opt-in arrangement for members:

- under age 25

- with balances of less than $6,000, and

- whose accounts have not received a contribution in 13 months and are inactive account.

Recent changes

On 27 April 2018, the Revenue and Financial Services Minister, Kelly O’Dwyer, announced the government’s decision to increase the maximum number of members in a SMSF from four to six. The Budget confirms this!

This increase in fund membership will help small business owners and families comprising say mum and dad and up to four children (or two children with their spouses) set-up an SMSF, especially where a family business, including a family farm, operating over several generations is involved. However, this won’t come without its own problems and complexity! Whilst the Cooper Review several years ago recommended increasing the number of members to 10, the Government’s initiative now to increase membership could be seen as a means of combating the ALP’s proposal to stop franking credit refunds. Currently, less than 5 percent of SMSFs have three or four members.

Also, Superstream will be extended to include SMSFs which means that members can initiate rollovers between mainstream public offer (retail) and industry funds and their SMSF electronically – making it easier and faster!

Changes still in the pipeline

With little change to super in this year’s Federal Budget, there’s time to both catch-up on things arising from recent changes that must be done and prepare for those changes still in the pipeline.

We now have time for the ‘dust to settle’ … to a certain extent!

Here’s a re-cap of the more significant superannuation changes to deal with now and those that are in the pipeline.

Federal Budget 2016 – the start of the super reforms

Two years ago in the 2016 Federal Budget, the Treasurer announced the most significant changes to super in a decade with the introduction of the superannuation reforms.

We’re only just embarking on a regime that’s going to take time to digest. One fraught with danger and a real minefield for the unwary. Now more than ever, the need for quality financial advice is critical!

Just take the ability to make a simple personal after-tax contribution for example.

We’ve just had a decade where the non-concessional (after-tax) contributions cap was relatively straightforward, ending with simply $180,000 a year or, for people under age 65 at 1 July in a financial year, $540,000 over a three-year period – and people still got it wrong!

Now, whether or not you can make an after-tax contribution depends on how much you’ve got in super. If your TSB at 30 June 2017 is less than $1.6 million then you can contribute, provided you’re eligible, i.e. you’re not too old and if you are, whether you meet the work test. The bring-forward rule – your ability to increase your current year’s contribution by utilising the cap otherwise applicable in the next few years and the amount – depends on your age and how close your super is to $1.6 million. Also, what you’ve contributed in the past two years may come into play. Understandably, there’s going to be mistakes if you’re not extremely careful or you don’t seek expert advice!

Employees who ceased making salary sacrifice contributions to instead make their own personal deductible contribution(s) for the first time will need to get their ‘financial house in order’ to do so before 30 June. Not only must you make the contribution but you must also provide the super fund trustee with a notice of intent (NOI) to claim a tax deduction for the contribution. Be careful not to touch the contribution, i.e. roll it over to another fund, withdraw it, or start an income stream, before first lodging your NOI. A new experience for employees!

Accountants and financial advisers are still grappling with transitional capital gains tax (CGT) relief in the lead up to 30 June when many SMSF annual returns are due for lodgement. This is another important but complex measure arising from the super reforms.

CGT relief is the opportunity, where certain conditions are met, to reset the cost base of a fund’s asset(s) to market value where a member was required to reduce their retirement phase pension balance to $1.6 million by 1 July 2017 or they had a transition to retirement pension (of any value).

Last of the super reforms starting soon!

There is one final measure announced in the 2016 Federal Budget still to come into play from 1 July this year. It is the last and one of the few favourable measures to come out of the superannuation reforms. It is the ability to carry forward any unused concessional (pre-tax) contributions cap amount arising from 1 July 2018. Any unused amount can be carried forward on a rolling five-year basis and can only be used if your TSB is less than $500,000.

For example, if you and/or your employer only make concessional contributions of say $20,000 in 2018/19 – a shortfall of $5,000 from the concessional contributions cap of $25,000 – you can carry forward $5,000. Then, in 2019/20 you and/or your employer could, if you choose, make concessional contributions up to $30,000, provided your TSB is under $500,000.

This measure was implemented primarily to help people, especially women, temporarily off work, for example to raise children, to top-up their super savings once they re-enter the workforce. However, carrying forward unused concessional contributions cap amounts into future years may now reduce the tax effectiveness of those contributions given the reduced personal income tax rates.

Federal Budget 2017 – mixing super and housing!

In the 2017 Federal Budget the Treasurer introduced certain measures to address housing affordability. Two such measures were thrown into the superannuation arena which will soon take traction.

- The First Home Super Saver Scheme. This scheme allows people to save for your first home in the concessionally taxed super system. Since 1 July 2017, people saving for their first home could make voluntary contributions (both concessional and non-concessional) into their super fund. Then, starting from 1 July this year, people can apply, provided they’re eligible, for the release of their voluntary contributions together with associated earnings to help purchase their first home.

- ‘Downsizer contributions’. From 1 July this year if you sell your home owned by you or your spouse for a continuous period of at least 10 years and you are aged 65 or more then you may be able to contribute some or all the sale proceeds into super. These contributions, known as ‘downsizer contributions’, allow you to boost your super savings even if you’re otherwise ineligible to contribute under superannuation law due to your age, work status or the amount you’ve got in super, i.e. TSB.

To download the above article, please click here.