Greece Update

What is the likelihood and financial and market implications of a Greek default?

Overview

- Greece is attempting to unlock €7.2bn of funding from the ECB, IMF and EU.

- However, Eurozone financiers (led by Germany) and the IMF want to see significant reform in pensions and taxes in order to facilitate further funding.

- Complicating matters, the newly elected Syriza led Government in Greece (a left leaning govt) was elected with an anti-austerity mandate and has taken a hardline stance in opposing austerity measures. The 30 June repayment deadline for Greece for a €1.5bn tranche of funding has been reached with timely repayment unlikely to be made.

- At this point negotiations between Greece and its financiers in the lead-up to the 30 June repayment deadline have stalled.

- As a result the Greek government is now putting a ‘Referendum’ to the people on whether the austerity measures should be accepted.

- The Greek banking system has been temporarily closed, with withdrawal amounts being limited to €60 per day.

- Whilst market volatility is likely to increase, we don’t see this referendum or a Greek default as having a material impact on the global economic recovery.

What is the situation with Greece at present?

The Greek government, led by the left wing Syriza party, is attempting to negotiate with the European Central Bank (ECB), the International Monetary Fund (IMF) and the European Union (EU) for the release of the next €7.2bn in emergency funding. The funding is part of an ongoing program of stabilising the Greek economy and ensuring that the Greek economy remains part of the European Economy.

The Greeks have a deadline at the end of June for the repayment of €1.5bn and a further €3.5bn in July. If these payments are not made, then the Greeks will be in default. This is a situation the Europeans are keen to avoid, as it has major implications for the Greek banking system and has the potential to impact other parts of the European and Global banking system.

The Europeans are looking for the Greeks to implement a number of economic measures such as increasing the current pension age and increasing taxes – which will raise revenue and prevent the financial position of the Greek government from worsening. The Syriza government, which was elected under an anti-austerity platform, has been pushing for a range of more lenient measures.

This is where the current impass lies.

Why has a referendum been called?

The Greek government has called for a Referendum to be put to the people on the current range of measures put forward by the Europeans. ‘Do you approve/agree with the range of measures put forward by the institutions’? This can be seen as a political tactic and a way for the government to continue to be seen as defending the citizens and not losing face if the vote is passed in the affirmative.

Even if the vote is passed, the Greeks will likely be in technical default as the original deadline will have expired. The referendum, whilst bringing the current funding decision to a head, is actually a side-show in the broader conversation of whether Greece should remain part of the Eurozone.

The Greek Banking system is now closed until this is resolved. Banks are set to be closed until July 6th with cash withdrawals at ATM’s limited to €60 per day.

What are the longer term implications of Greece and will it remain in the Eurozone?

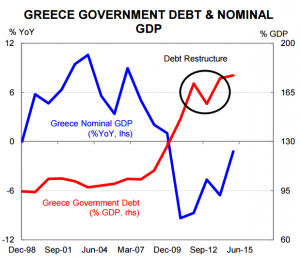

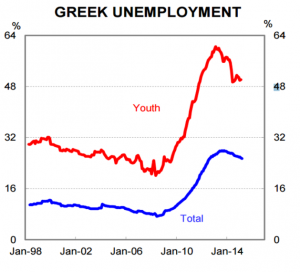

The Greek economy remains in a precarious position. Unemployment is at extreme levels and the economy has little in the way of flexibility in its monetary mechanisms (such as exchange rates) to pull itself out of its malaise. The current levels of debt are extreme and the Greeks simply cannot make these payments without significant structural and social reform. Even with this reform, the standard of living will continue to decline for Greeks – impacting the current and future generations.

Souce: Fitzpatricks, UBS

Unfortunately, it is impossible to predict whether the Greeks will remain in the Eurozone. The recent deadlock in the negotiations will have increased the probability of a Greek exit. The major concern for policy makers is the potential impact on the banking system and the contagion to other economies in Europe. A worst case situation might mean that the ECB no longer supports the Greek banks, with the Greek government in no position to provide funding. This would see a run on the banks’ finances and could potentially lead to social unrest, and we have started to see signs of this. This could in-turn lead to a flight to safety, with a run on less-capitalised banks in other parts of Europe and a sell-off across financials and credit markets.

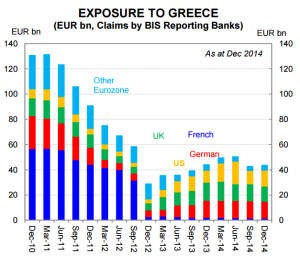

However, we believe that this situation will be avoided at all costs. Whilst it is not inconceivable that we see a Greek exit, the IMF, ECB and EU have policies in place to protect other parts of the European banking system. We have also seen an improvement in the capitalisation of the European banking system over the past five years, with the southern Europeans now less susceptible to flow-on impacts of a Greek default.

That is not to say that Greece will not be impacted. A Greek exit from the Euro would see a major devaluation in their new currency, large deflation in asset prices and low standards of living.

Either way, the Greeks have a number of tough decades ahead of them. We think the Europeans however are better positioned for such an event.

Source: Fitzpatricks, UBS, Commbank

What this means for markets and your portfolio?

Given the uncertainty around the referendum and potential for a Greek exit, markets are likely to remain volatile in the near-term. However, we expect that the implications of a Greek exit from the Eurozone are manageable, and a significant restructuring of loan portfolios has materially reduced the risk of contagion within the broader European financial system of a Greek default. We do not believe that this should change our view on the overall improvement in the global economy. Earlier in the year we increased our allocation to Europe in some of our portfolios as part of our overall equities positioning and believe that the European economy will continue to recover. Whilst we expect that the near-term uncertainty surrounding Greece is likely to result in higher than average levels of volatility in share markets, we are actively monitoring valuation fundamentals and remain prepared to act and take advantage of any mis-pricing that invariably arises as a result of higher levels of volatility.

We would see this as an opportunity to reweight our portfolios for continuation of this global recovery theme.

It is also worthwhile to highlight the likely implication that monetary accommodation (lower interest rates) will continue for longer than would have otherwise been the case. This should somewhat support equity and bond markets. The US Federal Reserve has already made the change to start referencing “international developments”, a big change from the view it took 3 or 4 years ago.