2022-23 Federal Budget

By Colin Lewis, Head of Strategic Advice

March, 2022

How sweet it is with an election looming!

The measures announced this Budget are proposals only and must go through Parliament to become law. Accordingly, it may take a newly elected Coalition Government to get these measures through – and they’re counting on this Budget to help them get re-elected.

One-off cost of living payment

To help Australians meet cost of living pressures, the Government is providing a one-off, tax-exempt payment of $250.

It will be paid automatically to all eligible pensioners, welfare recipients, veterans and eligible concession card holders – including Commonwealth Seniors Health Card (CSHC) holders – in April 2022.

The payments will not count as income support for purposes of any income support payment.

Temporary fuel excise relief

The Government will reduce fuel excise by 50 per cent for 6 months. This will see excise on petrol and diesel cut from 44.2 cents per litre to 22.1 cents per litre.

Fuel subject to this lower excise rate is expected to flow through to the majority of service stations and Australian consumers within a few weeks as stations replenish their stocks.

The rest of this paper focuses on proposed measures in the Budget that relate to financial planning only.

Personal Income Tax

The ‘lamington’ is increasing with a ‘cost of living tax offset’

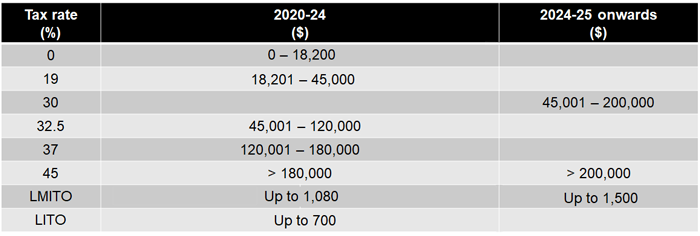

The Government will increase the low and middle income tax offset (LMITO) – dubbed the lamington – for the 2021-22 income year.

The LMITO will increase by $420, thus providing a reduction in tax of up to $1,500 for individuals – or $3,000 for dual income couples.

Other than those that do not require the full offset to reduce their tax bill to zero, all LMITO recipients will benefit from the full $420 increase.

Consistent with the current LIMTO, taxpayers with incomes of $126,000 or more will not receive the additional $420.

The LIMTO for the 2021-22 income year will be paid from 1 July 2022 when people lodge their tax return for this year. The LIMTO ceases on 30 June 2022.

When the Government’s Personal Income Tax Plan is fully implemented in 2024-25, around 95 per cent of taxpayers will face a marginal tax rate of 30 per cent or less.

Source: Fitzpatricks Private Wealth

Medicare levy low-income thresholds increased

From the current financial year – 2021-22 – the Medicare levy low-income thresholds for singles, families, seniors and pensioners will be increased. The increase in thresholds takes account of recent movements in the CPI so that low-income taxpayers continue to be exempt from paying the Medicare levy.

The thresholds will increase as follows:

- For singles from $23,226 to $23,365.

- For families from $39,167 to $39,402.

- For single seniors and pensioners from $36,705 to $36,925.

- For family seniors and pensioners from $51,094 to $51,401.

- For each dependent child or student, the family income thresholds will increase by a further $3,619 instead of the previous amount of $3,597.

Business tax

Small business – skills and training boost

The Government is introducing a skills and training boost to support small businesses to train and upskill their employees. The boost will apply to eligible expenditure incurred from 7:30 PM (AEDT) on 29 March 2022 until 30 June 2024.

Small businesses – with aggregated annual turnover of less than $50 million – will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees. These courses will need to be provided to employees in Australia or online and delivered by entities registered in Australia.

Some exclusions will apply – such as for in-house or on-the-job training and expenditure on external courses for persons other than employees.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024 will be included in the income year in which the expenditure is incurred.

Small business – technology investment boost

The Government is introducing a technology investment boost to support digital adoption by small businesses. The boost will apply to eligible expenditure incurred from 7:30 PM (AEDT) on 29 March 2022 until 30 June 2023.

Small businesses – with aggregated annual turnover of less than $50 million – will be able to deduct an additional 20 per cent of the cost incurred on business expenses and depreciating assets that support their digital adoption – such as portable payment devices, cyber security systems or subscriptions to cloud-based services.

An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible to boost.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2023 will be included in the income year in which the expenditure is incurred.

Employee Share Schemes

The Government will expand access to employee share schemes (ESSs) and further reduce red tape so that employees at all levels can directly share in the business growth they help generate.

Start-ups will be able to offer staff huge incentives and bonuses under a shake-up of ESSs.

The cap on the value of shares that can be issued to non-C-suite employees – that is, non-executive level managers in a company – is being scrapped and replaced with a fixed cap on the amount employees pay for them.

This latest overhaul will help unlisted start-ups compete with overseas rivals and ASX-listed heavyweights to attract staff with in-demand skills by offering them the ability to build worthwhile equity in the business.

“These reforms will expand the availability of employee share schemes to more companies and employees and allow employees to benefit from a larger share of the business’ growth,” Treasurer Josh Frydenberg said.

ESSs allow companies to gift or sell shares to staff at a discount, or even through loans or salary sacrificing deals. But the current ‘value cap’ limits the value of shares that can be issued to non-executive staff to

$5,000 a year.

Unlimited value

Under the new rules, companies will be able to offer an unlimited number of shares of unlimited value so long as an employee is not charged more than $30,000 a year for them. The new ‘monetary cap’ will apply to shares that have to be paid for on issuance and options that have to be purchased.

Where an option or right is granted and the shares are paid for at a point in the future, the employee will be able to accrue their annual $30,000 cap for a maximum of five years, plus 70 per cent of dividends and cash bonuses.

For example, it allows an employee to be granted an option to buy 0.5 per cent of a company’s shares at a 90 per cent discount if the company hits a $100 million valuation at a point in the future.

Say in two years, the company hits a $100 million valuation, the employee will be able to pay $50,000 – the value of the shares at a 90 per cent discount – as their accrued cap over two years would be $60,000.

Further, the monetary cap will not apply where an employee can profit from the sale of a business or an initial public offering (IPO). In this situation, an employee can pay any amount for shares under an ESS so long as those shares are sold for a realised profit shortly afterwards.

These changes add to last year’s budget measurers which removed cessation of employment as a taxing point on shares issued under an ESS. Existing taxing points, including where shares and options can be disposed of without penalty or realised without risk of forfeiture and the 15-year maximum deferral period, are retained.

This overhaul removes roadblocks that disadvantage Australian start-ups.

Cutting red tape

Unlisted companies using ESSs are also given a reprieve on onerous red tape obligations with simplified disclosure rules.

Currently, only employers offering shares to C-suite executives are exempt from supplying disclosure statements, such as a share prospectus.

Under the changes, where any employee is offered shares under an ESS at no cost, the employer will not have to provide a disclosure statement, while the purchase of shares or options will only require a simplified disclosure.

The changes make establishing and participating in ESSs simpler.

The aim is to create a virtuous cycle that accelerates the creation of new companies (and jobs), as employees that benefit from EESs are more likely to leave and found their own company with share proceeds, and thus create more successful companies (and new jobs).

Superannuation

With an impending election, changes to the superannuation system were never on the cards.

Extending the temporary reduction in minimum pension drawdown rates

In the lead-up to the Budget – and reiterated therein – the Government announced that it is extending the 50 per cent reduction to minimum annual pension payments for another year. The minimum pension drawdown rates remaining halved for 2022-23 is good news for retirees that do not need money to live off from their account-based pensions and similar income streams.

Thankfully, the Government did NOT meddle with super

Superannuation – once a soft target for raising government revenue – is gradually moving beyond the reach of politicians. They have backed off in the face of changed community perceptions and super’s status as a sacrosanct saving vehicle.

Super’s ascension to a position beyond the reach of politicians seeking revenue matches changing community attitudes – well summed up in research commissioned by the Association of Superannuation Funds of Australia.

Although many Australians are concerned that they may not have enough money saved to live well when they retire, they are also concerned that others who don’t save might become a burden on taxpayers.

“Australians believe that more money should be saved for their retirement, not less,” the research found.

The Government

Only days before the Budget, the Minister for Superannuation, Jane Hume, stated in the clearest possible terms that “there will be no increase in super taxes under a Coalition government … There will be no sneak tax increases via by making it more difficult to put money into super under a Coalition government.”

With an eye to potentially wedging Labor over the policies it took to the last election, the Government said it will not meddle with superannuation.

Hume said there will be:

- no adverse changes to super taxes

- no adverse changes to contribution limits

- no adverse change to the $250,000 Division 293 tax threshold before the 15 per cent tax on super contributions comes into play, and

- definitely no changes to the government’s contribution flexibility measures, including:

– no change to the ability of retirees up to the age of 74 to make contributions without meeting the work test

– no change to catch-up contributions, and

– no change to the concessions for a couple downsizing to a smaller house to put an extra $300,000 into super.

Labor

Whenever Opposition Leader Anthony Albanese has been asked about Labor’s previous tax policies, he has responded with the phrase: “It is not our policy until we announce it.”

Opposition treasury spokesman Jim Chalmers has said “We’ve said consistently that we won’t take the same policy agenda to this election that we took to the last election … All of our policies will be clearly set out before the election.”

It’s clear that a decision is yet to be made on these issues, but with about six weeks to go before the election and given the Coalition’s pressure, it’s likely Labor will do nothing.

Measures announced in last year’s Budget

The Government announced all it’s important changes in last year’s Budget and in February most were brought to life.

The most significant – and widely publicised – being the ability for people aged 67 to 74 to make non- concessional contributions (NCCs) and salary sacrifice contributions from 1 July this year without having to meet the work test, together with the NCC bring-forward rule being extended to this age group subject to their total superannuation balance.

Another less publicised, less sexy but nevertheless important change affecting self-managed superannuation funds (SMSFs) and small APRA funds (SAFs) also came into play – the way trustees determine their fund’s exempt current pension income (ECPI). This is the income a fund earns from assets supporting retirement phase pensions which is exempt from tax.

There are two methods for calculating a fund’s ECPI – the segregated method and the proportionate (unsegregated) method.

From this financial year onwards, SMSF and SAF trustees may choose their method of calculating ECPI when they have member interests in both accumulation phase and retirement phase for part, but not all, of the income year – that is, where a fund has a member(s) in both accumulation and retirement phases at one time, but retirement phase only at another time, during the year.

These trustees can choose to treat their fund assets as not being segregated current pension assets, thus, enabling them to use the proportionate method for calculating ECPI for the whole year.

Before 1 July 2017, the established industry practice for SMSFs and SAFs partly in pension phase and partly in accumulation phase during the year was to calculate ECPI using the unsegregated method for the entire year – even if there were periods where the fund was in pension phase only.

Since 1 July 2017, the ATO has applied strict guidelines which removed a trustee’s choice of ECPI method and increased the administrative burden and cost to funds. But this change means that trustees are once again allowed to apply the pre-1 July 2017 industry approach to calculating ECPI.

Other superannuation measures that are now law include:

- Extending access to downsizer contributions – from 1 July 2022, the minimum age for making a downsizer contribution reduces to age 60.

- Removing the minimum threshold for Superannuation Guarantee (SG) eligibility – from 1 July 2022, the current $450 per month minimum income threshold, under which employers are not required to make SG payments for employees, no longer applies.

- Increasing the maximum releasable amount under the First Home Super Saver Scheme (FHSSS) – from 1 July 2022, the maximum releasable amount of voluntary contributions made over multiple years under the FHSSS increases from $30,000 to $50,000.

What about the measures in last year’s Budget that didn’t become law?

These measures include changes to the residency requirements for SMSFs and SAFs, and the legacy pension amnesty.

Proposed changes to the residency rules for SMSFs included extending the central control and management test safe harbour from 2 to 5 years for SMSFs and removing the active member test for both SMSFs and SAFs.

SMSF and SAF members would be able to continue contributing to their fund whilst temporarily overseas – ensuring parity with members of public-offer funds, such as retail and industry funds.

The legacy pension amnesty would allow people to exit a specified range of retirement products, together with any associated reserves, for a 2-year period.

These measures have not progressed since last year’s Budget – there’s been no draft legislation or exposure drafts from Treasury.

With so few parliamentary sitting days, it’s a tight window to get legislation that exists through – let alone measures yet to see draft legislation.

So, it’s highly unlikely these measures will be legislated before the election.

It will be interesting to see what gets through and what doesn’t, and depending on the outcome of the election, whether these measures are reintroduced or not.

Home Buyers

Finding ways to help more people buy their own home has been a political challenge for decades.

Heading into the election, both the Coalition and Labor agree on at least one policy – expanding the First Home Guarantee (FHG), formerly the First Home Loan Deposit Scheme.

The policy – which allows some first home buyers to purchase a property with as little as a five per cent deposit – will more than triple in size. And specific carve-outs will be created for those looking for a home in booming regional markets.

The scheme has proved popular since its creation in 2019 and housing industry groups have broadly welcomed the expansion as helping more first home buyers enter the market. However, some industry experts are worried that, while it might help address a symptom of rising house prices – the need for ever- larger deposits – it won’t do anything to address the bigger problem.

What is the scheme?

The biggest challenge most first home buyers face is saving for a deposit. Most lenders require a 20 per cent deposit before they will approve a home loan, or they will slug the borrower an expensive fee for lender’s mortgage insurance (LMI) – basically to protect themselves.

So, if you want to buy an $800,000 property, you will need $160,000 in the bank, plus extra for stamp duty and all the other costs associated with buying a home.

The FHG aims to reduce that burden, by allowing first home buyers to purchase with just a 5 per cent deposit, while the Federal Government acts as a guarantor for the other 15 per cent – allowing a lender to approve the loan without the need for LMI.

There are limits on who can access it and what they can buy, as well as caps on income for first home buyers, and price limitations on properties depending on their location.

The FHG is available to single people earning up to $125,000 a year and couples earning up to $200,000.

Price caps in the program differ across the country, to reflect different property markets across states and territories. It varies from $800,000 in the major centres of New South Wales – such as Sydney and Newcastle – to $350,000 in regional South Australia. Analysis conducted by property market researchers CoreLogic found that, in some cases, the price caps leave buyers with seriously limited options.

Different variations of the scheme have been launched – such as the Family Home Guarantee – which helps single parents buy with a deposit as small as 2 per cent.

Both sides of politics have now sought to grow the policy. Labor got in first, last week announcing it would create another version of the scheme dedicated to regional buyers, with 10,000 places. Then, the Coalition Government went bigger.

The number of guarantees under the Home Guarantee Scheme will increase to 50,000 a year for 3 years from 2022-23 and then 35,000 a year ongoing to support homebuyers to buy a home with a low deposit. The guarantees will be allocated to provide:

- 35,000 guarantees per year ongoing for the FHG

- 5,000 places per year to 30 June 2025 for the Family Home Guarantee

- 10,000 places per year to 30 June 2025 for a new Regional Home Guarantee (RHG) that will support eligible citizens and permanent residents who have not owned a home for 5 years to purchase a new home in a regional location with a minimum 5 per cent deposit.

Labor welcomed the adoption of the RHG and is expected to support the other changes.

Groups such as the Urban Development Institute of Australia and the Housing Industry Association welcomed the move, both arguing the “deposit hurdle” is a huge barrier to first home buyers getting into the market. However, others – such as the Grattan Institute – are more cautious. It argues that, while the scheme will undoubtedly allow more people to buy homes sooner than they otherwise would have, that can bring unintended consequences. “It will probably see home ownership rise a little bit … But you are going to potentially see higher prices. And that’s the trade off.”

Pharmaceutical Benefits Scheme – lowering the Safety Net threshold

From 1 July 2022, the Government will reduce the Pharmaceutical Benefits Scheme (PBS) Safety Net thresholds.

Patients will reach the Safety Net sooner each year, with approximately 12 fewer scripts for concessional patients and 2 fewer scripts for general patients in a calendar year.

On reaching the Safety Net, concessional patients receive their PBS medicines at no cost for the rest of the calendar year and general patients receive their PBS medicines at the concessional co-payment rate – currently $6.80 per prescription.

This is good news for self-funded retirees who do not hold a CSHC.

______________________________________________________________________________________________________________

The information in this document (information) has been prepared by Fitzpatricks Private Wealth Pty Ltd (ABN 33 093 667 595, AFSL 247 429) (Fitzpatricks). The information is of a general nature only and does not take into account the objectives, financial situation or needs of any person. Before acting on the information, investors should consider its appropriateness having regard to their own objectives, financial situation and needs and obtain professional advice. No liability is accepted for any loss or damage as a result of any reliance on the information. Past performance is not a reliable indicator of future performance. Future performance and return of capital is not guaranteed. The information may be confidential and is intended solely for the addressee. If you are not the intended recipient, any use, disclosure or copying of this information is unauthorised and prohibited. If you receive this document in error, please notify the sender and delete the document.