Do we want our children to be the “country club” kids?

Do we want our children to be the “country club” kids?

The rationale for this heading may seem controversial, but what we mean is, the common way of thinking is when we pass on, we equally divide our entire estate and let our beneficiaries i.e. children, work it out.

Think Paris Hilton, as an extreme case in point. Paris is the great-granddaughter of Conrad Hilton, founder of Hilton Hotels. With this type of wealth, Paris, doesn’t need or have to work, spending more time at the “country club” thus, not likely sharing the same values around work ethic and the value of money as the majority of us do.

It may also be spent quickly on luxury items or through divorce, bad decisions lost easily etc. – everyone has a story around this.

For most successful people and/or entrepreneurs nowadays, the added value of home, superannuation, life insurance and other accumulated investments can quite quickly add up to the millions. In many cases, people would like to see their money have the best chance of surviving the first generation and used to help future generations.

An alternative that is starting to get traction is the use of family constitution to help keep a family’s wealth for future generations – not just the next.

Setting a “rule book” on where the money is spent, and giving it the best chance of supporting the wider family group over time.

Case study example

Here’s a 6 million dollar estate.

A couple have decided to give their three children on their death, the following sums of money upon them reaching a certain age:

- $50,000 at age 18

- $250,000 at age 25, and

- $500,000 at age 30

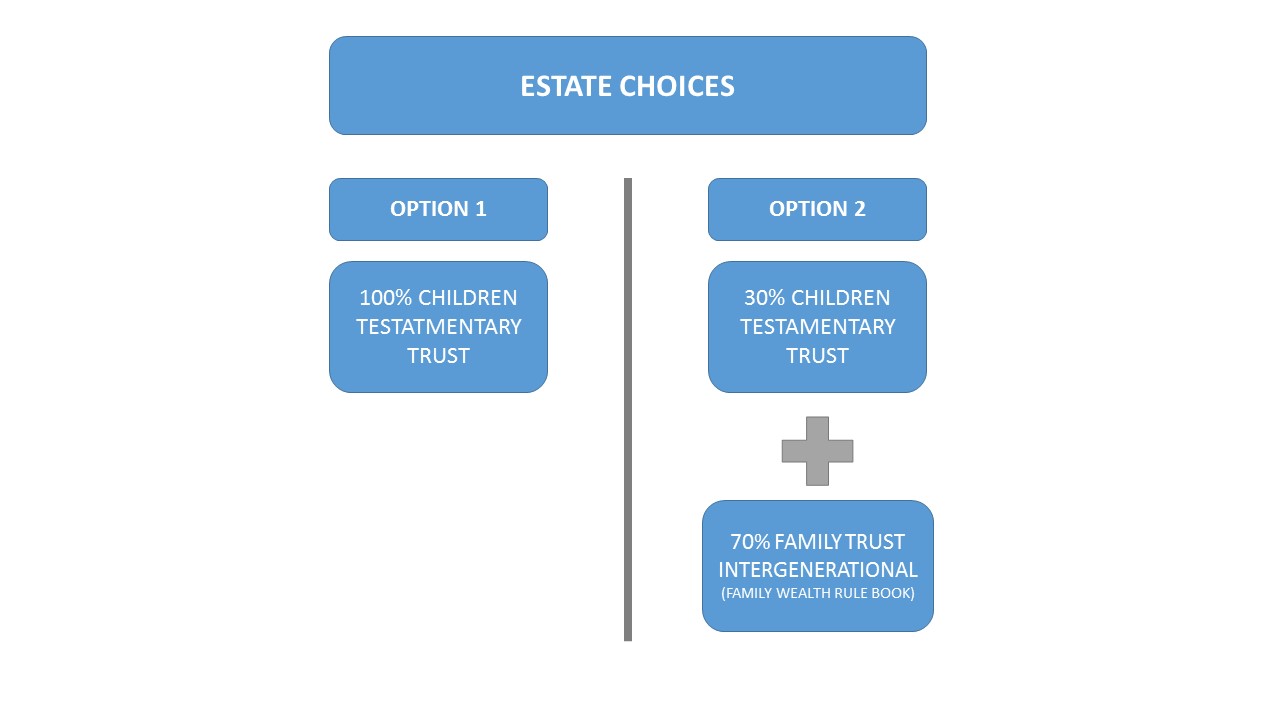

In total 2.4 million dollars, through the use of testamentary trusts or standard will.

Here’s the difference – instead of giving the whole amount to the three children, the remainder sits as the family bank (4 million dollars).

The remainder of the estate is held in the family trust(s) governed by a family constitution. This is the family rule book and sets out issues such as; who is the family member? I.e. your child marries someone with children, how the income is distributed approx. $120,000 to $200,000.

This could allow for a charitable donation of $20,000, beneficiaries of $60,000 to $80,000 and reinvestments of $40,000 to $100,000.

The trust can lead to beneficiaries within limits as well such as coping with children who may have different addictions, dealing with prenuptials, ability to finance future generations’ educational needs as well as setting an investment philosophy.

For illustration purposes, lets fast forward this trust in 10 years’ time, assuming a rate of return at 7% p.a.

Estimated value is 8 million dollars – in 20 years, an estimated value of 16 million dollars and 30 years’ time an estimated value of 32 million – you get the idea!

Many families like the idea of keeping the money together for not only their children but future generations. It still acts as a support mechanism for the children, but it not theirs to spend! This is not for everyone, but a worthy discussion point.

By Scott Fitzpatrick, Founder, Fitzpatricks Private Wealth

Scott Fitzpatrick is an authorised representative of Fitzpatricks Private Wealth Pty Ltd. The information in this article is of general nature only, it is important you speak to your financial adviser before acting on this information.

For more information on estate planning and testamentary trusts, please contact your financial adviser.