Federal Budget 2016 highlights

FEDERAL BUDGET 2016

The Federal Treasurer Scott Morrison delivered his inaugural Federal Budget speech to the nation last night with the message of jobs and growth, and having an economic plan to transition the economy. Business is a winner, particularly small and medium size businesses, due to the progressive reduction in the company tax rate, and an increase in the turnover threshold for those eligible to receive various corporate tax concessions. Superannuation changes impact many, particularly those who have higher account balances, or desires to make larger contributions to superannuation, or are using transition to retirement income strategies, albeit many changes are not due to come into effect until 1 July 2017. Unemployment is expected to fall slightly, economic growth is expected to increase to 3%, and the size of the deficit will decline – outcomes which the Government is hoping voters will appreciate. The reduction in the official interest rates, announced by the Reserve Bank (to 1.75%) is also likely to be helpful in terms of promoting economic growth.

Marginal personal tax rate change

As expected, the Government will increase the threshold where the marginal tax rate increases from 32.5% to 37%, from $80,000 to $87,000. This change will apply from 1 July 2016 and will impact on about 500,000 taxpayers. The change will result in a worker earning $81,000 receiving a tax cut of $45 for the year, and a worker earning $87,000 or above receiving a tax cut of $315 a year.

Reduction in company tax rate to 25% over 10 years

Small businesses will receive a reduction in company tax rate from 28.5% to 27.5% effective from 1 July 2016. In addition the definition of a small business will expand from the current $2 million of turnover to $10 million of turnover, which will result in more small businesses being eligible for this lower company tax rate from 1 July 2016.

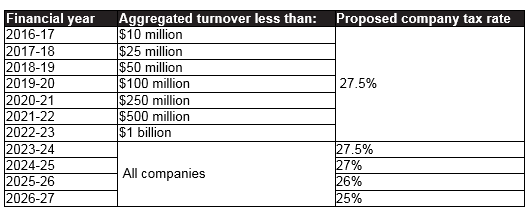

Companies with turnover greater than $10 million will remain on a higher 30% company tax rate. However, by increasing the aggregated turnover threshold on a progressive basis each income year, ultimately all companies will be taxed at 27.5% by the 2023-2024 income year.

Furthermore, in the 2024-2025 income year, the company tax rate will be reduced to 27%, and then reduce progressively by 1% each year until it reaches 25% in 2026-2027. Franking credits will be able to be distributed in line with the rate of company tax paid by the company.

The reduction will apply incrementally based on aggregated turnover as shown in the table.

Increase in turnover Threshold for Small Business

The Government will increase the small business entity turnover threshold from $2.0 million to $10.0 million from 1 July 2016. The current $2.0 million turnover threshold will be retained for access to the small business capital gains tax concessions, and access to the unincorporated small business tax discount will be limited to entities with turnover less than $5.0 million. An additional 90,000 to 100,000 business entities will gain access to the small business concessions, such as the lower small business corporate tax rate, accelerated depreciation and depreciation pooling provisions. This means many more businesses will be able to take advantage of accelerated depreciation (and depreciation pooling), allowing instant write off on assets up to $20,000.

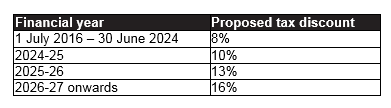

There will also be an increase in the unincorporated small business tax discount, in a similar progressive basis, to coincide with the reduction in company tax rates. The tax discount applies to the income tax payable on the business income received from an unincorporated small business entity. Access to the discount will be extended to individual taxpayers with business income from an unincorporated business that has an aggregated annual turnover of less than $5.0 million. The current discount for unincorporated small businesses (sole traders and partnerships) will be increased over ten years from 5% to 16%.

New diverted profits tax

The Government will introduce a diverted profits tax which is targeted at multinational companies who divert profits from Australia. A 40% tax on diverted profits will apply from 1 July 2017 and applies to large companies with global revenue of $1 billion or more. The anticipated revenue increase from this tax is $100m in the 2018-2019 income year.

Superannuation reform package

The changes to superannuation are significant, although the Budget papers state that 96% of individuals with superannuation are unaffected by the changes.

$1.6 million superannuation transfer balance cap

The Government intends to introduce a $1.6 million superannuation transfer balance cap on the total amount of superannuation an individual can transfer into retirement phase accounts, effective 1 July 2017. Subsequent earnings on these balances will not be restricted. This places a limit on the amount in tax free retirement pension, with no limit on the amount outside these accounts or outside of superannuation.

Amounts retained in superannuation above this lifetime cap will be able to remain in superannuation, but the earnings will be taxed at the standard superannuation tax rate of 15%. Members already in retirement phase with balances above $1.6 million will be required to reduce their retirement balance to $1.6 million by 1 July 2017. It seems that a tax on the amount transferred in excess of the $1.6 million cap (including earnings on these excess transferred amounts) will be applied, similar to the tax treatment that applies to excess non concessional contributions. The budget papers state the amount of cap space remaining for a member seeking to make more than one transfer into a retirement phase account will be determined by apportionment.

Commensurate treatment for members of defined benefit schemes will be achieved through changes to the tax arrangements for pension amounts over $100,000 from 1 July 2017. Given the seemingly retrospective nature of this intended change, and slightly confusing explanation of this change in the budget papers, it is pleasing that the Government intends to consult further on the implementation of this measure.

More to incur additional contributions tax

Currently those with incomes and superannuation contributions over $300,000 pay an additional 15% tax on superannuation contributions. This is known as the division 293 threshold and is the point at which higher income earners pay additional contributions tax. Effective 1 July 2017, this threshold will reduce to $250,000, meaning more people will incur additional tax on superannuation contributions.

Reduction in concessional super contributions cap to $25,000

Effective 1 July 2017, the concessional contributions cap will reduce to $25,000. Subject to other changes and circumstances, a possible action is to maximise concessional contributions to superannuation in the next 7 weeks before 1 July 2016, and again in 2016-2017 year before the caps are lowered on 1 July 2017.

$500,000 lifetime cap on non-concessional contributions

Effective immediately (7.30 p.m. AEST on 3rd May 2016), the Government will introduce a $500,000 lifetime cap on non concessional contributions. This cap will take into account all non concessional contributions made on or after 1 July 2007 for which the Australian Taxation Office has reliable contribution records. Contributions made before commencement (7.30pm AEST on 3rd May 2016) cannot result in an excess. However, excess contributions made after commencement will need to be removed or subject to penalty tax. The cap will be indexed. The Government intends to implement legislation which has a similar impact on defined benefit funds. It seems that this provision will effectively remove the current non concessional contribution cap.

Low income superannuation tax offset

The low income superannuation tax offset will be introduced from 1 July 2017, and will replace the low income superannuation contribution which expires on this date. This measure applies to taxpayers with adjusted taxable incomes below $37,000, and effectively results in a refund of the tax paid on concessional contributions up to $500.

Increase in age for those able to claim a tax deduction for concessional contributions

From 1 July 2017, the current restrictions which allow individuals under the age of 75 to claim a tax deduction for concessional contributions, will be altered. The effect is to allow all individuals, regardless of employment circumstances, to make concessional contributions up to the concessional cap. This may create some opportunities for those who have been unable to maximise super contributions.

The complexities regarding the work test and current variation in these tests for those aged 65 to 74 depending on age and type of contribution will also be simplified from 1 July 2017. The Government has announced its intention to apply the same contribution acceptance rules for all individuals aged up to 75.

Increase in eligibility to receive the spouse superannuation tax offset

More people will be eligible to receive the spouse contribution offset, worth up to $540 for contributions made to an eligible spouse’s superannuation account, due to the increase in the income threshold from $10,800 to $37,000. The actual maximum offset of $540 has not been increased, just the potential number of people who may receive this offset. This measure is effective 1 July 2017.

Concessional contributions “catch-up” provisions

The Government will introduce concessional contributions “catch-up” provisions. This will allow any unused concessional contributions cap to be carried forward on a rolling five years for those with account balances of $500,000 or less. This measure is aimed at assisting those with lower contributions due to interrupted or irregular working patterns to make “catch-up” contributions. Details of how this will be administered are not covered in the budget papers. This change is effective from 1 July 2017.

Changes to transition to retirement income streams – no longer tax exempt earnings

From 1 July 2017, the tax exemption on earnings of assets supporting transition to retirement income streams will be removed. More broadly, individuals will no longer be allowed to treat certain superannuation income stream payments as lump sums for tax purposes.

Other superannuation reform package announcements

In an attempt to bring about innovation in the types of retirement income products available to consumers, from 1 July 2017, the Government will extend the tax free earnings in retirement phase to products such as deferred lifetime annuities and group self-annuitisation products.

The anti-detriment provisions will also be amended, effective 1 July 2017. The anti-detriment provision can effectively result in a refund of a member’s lifetime superannuation contributions tax payments into an estate, where the beneficiary is the dependant of the member (spouse, former spouse or child). Currently this provision is applied inconsistently by superannuation funds, so from 1 July 2017 the Government will no longer allow funds to claim this as a deduction.

End of 2015-2016 Financial Year Considerations

Superannuation

Superannuation can be a tax effective way to help build wealth for retirement. This is because, for a complying super fund, the tax on earnings is up to 15% in accumulation phase, and nil in pension phase.

Currently there are various rules which govern who can contribute to superannuation depending on age, type of contribution and working status. In general, anyone can contribute to superannuation if under the age of 65. Between the ages of 65 and 74, you will be required to meet a work test, which is 40 hours over 30 consecutive days in the financial year when the contribution is made. Once you are 75 or over, only mandated employer contributions (i.e. super guarantee or SG) will be able to be contributed to super.

On Tuesday 3rd May 2016, the Federal Treasure Mr Scott Morrison delivered the Federal Budget. This included a number of proposals to alter tax rates for companies and individuals, plus many changes to superannuation. Most, not all, of these changes are intended to apply from 1 July 2017. Most of the changes are announcements and are not, as yet, supported by legislation. This is important in terms of determining action, if any, required in the immediate period.

Maximise concessional contributions for the 2015-2016 financial year

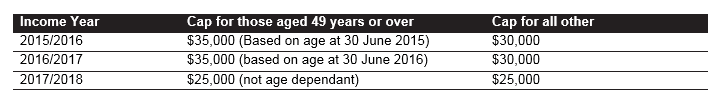

Concessional Contributions can be an effective way to contribute to superannuation as they are made from pre-tax income. Concessional contributions may assist in reducing personal taxable income. The cap is based on the age of a person as at 30 June of the previous financial year (2015). As outlined in the 2016 Federal Budget and summarised in the table below, effective 1 July 2017, the concessional contributions cap will reduce to $25,000.

A concessional contribution is generally a super contribution to a complying super fund which is included in the super fund’s assessable income. Concessional contributions attract a 15% “contributions tax” which is paid by the super fund. For those on incomes above $300,000 a further 15% tax will apply to concessional contributions. Note that the 2016 Federal Budget outlined a plan for the income threshold for the additional 15% tax to apply, to be lowered to those with incomes of $250,000 or more, effective from 1 July 2017.

For many people these rates of tax are lower than the tax rate on regular income, meaning the tax advantage remains to make concessional superannuation contributions. Concessional contributions include employer contributions (including SG and salary sacrifice) and personal contributions made by the member, for which a valid deduction notice is submitted and acknowledged.

Any concessional contributions above the above caps are effectively taxed at your marginal tax rate. An excess concessional contributions interest charge will also apply. You can elect to withdraw up to 85% of any excess concessional contributions from your superannuation to help pay your income tax assessment when you have excess contributions.

An important note – salary sacrifice arrangements are only valid for future earnings and not for income and entitlements you have already earned.

Suggested Action: Consider making the maximum concessional contributions to superannuation in the next 7 weeks before 1 July 2016, and again in 2016-2017 financial year before the caps are lowered on 1 July 2017. This would permit concessional contributions up to $70,000 to be made over two financial years, whereas under the proposed lower concessional contributions caps, a more modest $50,000 could only be contributed. The lowering of the income threshold to $250,000 where an additional 15% tax is applied to concessional superannuation contributions, is further reason to accelerate the level of concessional contributions.

Review non-concessional contributions

Effective from 7.30 p.m. AEST on 3rd May 2016, the Government will introduce a $500,000 lifetime cap on non concessional contributions. This cap will take into account all non concessional contributions made on or after 1 July 2007 for which the Australian Taxation Office has reliable contribution records. Contributions made before commencement (7.30pm AEST on 3rd May 2016) cannot result in an excess. However, excess contributions made after commencement will need to be removed or subject to penalty tax. The cap will be indexed. The Government intends to implement legislation which will have a similar impact on defined benefit funds.

Despite this change, non concessional contributions are still a very effective method to boost retirement savings tax effectively. Non-concessional, or after-tax, contributions are an effective method to get more money into the superannuation system. In simple terms, these contributions, if within the caps, do not attract the 15% “contributions tax”. Non concessional contributions enable money to be held in the generally lower taxed superannuation and pension environment.

Until the 2016 Federal Budget, non concessional contributions were capped at $180,000 for each financial year. If you were under age 65 at any time in a financial year, it was possible to “bring forward” two years’ of non concessional contributions allowing a total non concessional contribution cap of up to $540,000 over three years. Prior to making any non concessional contributions, it is very important to review any contributions made during prior years.

Suggested Action: Given this change is proposed to be effective immediately, but is not yet legislated, it is important to obtain current advice before proceeding with making non concessional contributions.

Government co-contributions

Government co-contributions provide the opportunity to receive a co-contribution of up to $500 from the Government to help increase your retirement savings. The maximum government co-contribution amount is available if income is below $35,454, and this reduces on a sliding scale until it become non available if income exceeds $50,454. In general, to be eligible, you must make a personal non concessional contribution and not claim a tax deduction for the contribution, be under 71 at the end of the financial year, lodge a tax return and receive 10% or more of your total income from eligible employment and/or carrying on a business. If eligible, you do not need to apply to receive this modest assistance to your retirement savings – the Australian Taxation Office will automatically calculate the co-contribution and deposit the amount into your superannuation fund.

Low income superannuation contributions

The low income super contribution cap of up to $500 will be abolished from 1 July 2017. Eligibility is based on having taxable income under $37,000 and making a concessional contribution (i.e. SG) during the financial year. If eligible, the Australian Taxation Office arranges for the contribution to be made to your superannuation fund, up to $500. From 1 July 2017, as announced in the 2016 Federal Budget, the low income superannuation tax offset will be introduced and will replace the low income superannuation contribution which expires on this date.

Spouse contributions

Spouse contributions are non concessional contributions that you can make on behalf of your spouse. The contributing spouse may be eligible for a tax offset of 18% on contributions up to $3,000. (Note the maximum tax offset of up to $540 will depend on the spouse income level and contribution amount). To be eligible you must make a non concessional contribution into your spouse’s complying super fund in the financial year and not claim a tax deduction for the contribution. Your spouse must have total income below $13,800, and be under age 65, or if aged 65 but under age 70 must meet the work test. Spouse contributions count towards the spouse’s non concessional contribution cap. An announcement in the 2016 Federal Budget, will make more people eligible to receive this offset from 1 July 2017, however the maximum offset amount of $540 will not alter.

Contribution splitting opportunities

Contribution splitting gives you the opportunity to increase your spouse’s superannuation using money you have contributed to superannuation. You can split up to 85% of concessional contributions (up to the concessional contribution cap) where your spouse has not reached preservation age, or has reached preservation age but is under age 65 and has not retired. To split a contribution, you must apply to your super fund by the earlier of the day you request your entire account balanced to be rolled over, transferred or cashed in for the financial year in which the contribution was made or by the end of the following financial year after the contribution was made.

Contributions which are split continue to count towards your concessional contribution cap so contribution splitting will not be useful as a strategy to mitigate excess contribution tax. Contribution splitting can be effective to “even out” retirement benefits between spouses, or to enhance social security benefits, particularly if one partner is below pension age.

Note that the significant legislated changes in Asset Test rules (lower thresholds and more sever taper rates), which are effective 1 January 2017, may make super splitting a sensible strategy for some in both the current and next financial year.

Also note that preservation age was 55, but it has increased to 56 this year – i.e. if you have your 56th birthday this financial year (2015-2016), your preservation age, which is when you may be able to access your superannuation, cannot occur until you have actually had your 56th birthday.

Suggested Action: Contribution splitting will be worthy of greater consideration given the restrictions on contribution caps, legislated lower social security asset test limits, and proposed lifetime superannuation transfer balance cap. Superannuation splitting may be useful to “even out” balances between partners.

Superannuation income payment for the 2015-2016 financial year

If you are receiving a superannuation income stream, every year you are required to draw a minimum pension requirement from your superannuation pension account. At the 1st July each year, your minimum income pension is recalculated in accordance with Government rules.

Suggested Action: Please ensure you meet your minimum requirement for the financial year. This applies whether using a Transition to Retirement Income Stream strategy, or have an Account Based Pension.

Transition to retirement income stream strategies

The 2016 Federal Budget included a proposal to remove the earnings exemption for Transition to Retirement Income Streams. This potentially retrospective change will be effective from 1 July 2017, and if legislated will make this popular strategy much less tax effective.

Suggested Action: Review strategies which involved commencing retirement income stream strategies to take into account the long term effectiveness of these strategies. Existing transition to retirement strategies will also need to be reviewed, however this does not need to be an immediate action given this announcement is yet to be legislated and is not intended to be effective until 1 July 2017.

Summary of other significant proposed superannuation changes

The Government will introduce concessional contributions “catch-up” provisions. This will allow any unused concessional contributions cap to be carried forward on a rolling five years for those with account balances of $500,000 or less. This measure is aimed at assisting those with lower contributions due to interrupted or irregular working patterns to make “catch-up” contributions. This important change is proposed to be effective from 1 July 2017.

The Government intends to introduce a $1.6 million superannuation transfer balance cap on the total amount of superannuation an individual can transfer into retirement phase, effective 1 July 2017. Subsequent earnings on these balances will not be restricted. This places a limit on the amount in tax free retirement pension, with no limit on the amount outside these accounts or outside of superannuation. This proposed change will have a significant, and potentially retrospective effect on many.

Suggested Action: At this stage these are proposals and are yet to be legislated.

Small Business CGT – check eligibility for these generous provisions

There are a variety of concessions available to small business to reduce and potentially eliminate capital gain tax on the sale of business assets. Eligibility is dependent on a number of factors including level of business revenue or business assets, ownership structure and extent of ownership. The detail on how the proposed changes to contribution caps (lifetime transfer cap, and lifetime non concessional cap), as announced in the 2016 Federal Budget, and the impact, if any on the small business capital gains tax concessions and contributions to super is not yet available.

Suggested Action: Obtain professional advice in advance of, and post, the sale of a small business as it is very important to reduce the possibility of missing out on the various small business capital gains tax concessions.

Other actions to consider prior to the end of financial year

There are various other actions which may apply to you in the lead up to the end of the financial year.

Pre paying expenses may result in additional deductions this financial year, although differences in depreciation and tax rates between the current and the next financial year may mean deferral (rather than advancement) of expenses is preferable in some situations. This will depend on your personal and business structure, cashflows, tax rate, turnover level, expense type, etc. In relation to capital gains tax, the impact of this can be reduced by taking advantage of the small business CGT provisions (outlined above), and considering sensible timing of other asset sales and acquisitions.

Insurance premiums, particularly business expense and income protection/salary continuation policies, are usually tax deductible. In general, interest payments on deductible debt (i.e. business, investment and margin loans) which is producing assessable income is deductible, while interest payments on home and personal loans is usually not deductible.

Importantly, the above is general information only. Each person has different circumstances, income, cashflows, business structures, etc. Please find time to contact your professional advisers – accountant, financial adviser, legal service to check what the Federal Budget means for you and whether any actions are necessary in the short and medium term.

If you wish to discuss any of the above information further, please contact your financial adviser.

Important Information

Throughout this document Fitzpatricks Financial (Fitzpatricks) refers to Fitzpatricks Private Wealth Pty Ltd ABN 33 093 667 595, holder of Australian Financial Services Licence 247429. Fitzpatricks Financial is a registered business name of Fitzpatricks Private Wealth Pty Ltd.

The information in this publication is of a general nature only. All information has been prepared without taking into account your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial adviser, whether the information is appropriate for you.

Past performance is not a reliable indicator of future performance. When we speak of our investment objectives, particularly for performance, it is very important to understand that these are not forecasts, promises or guarantees. They are simply our goals. The performance or success of an investment through our investment strategies is not guaranteed. You can lose as well as make money. Actual performance will differ among clients depending on the timing of their investment and the level of variation from the models.