Updates

Dear FPW Adviser Community,

As you know, I have been away in Bali for a couple of weeks on honeymoon. After a spectacular wedding and celebration with close friends and family, the break was a much needed one. I had some time to reflect and take stock, as you do, when you have some down time.

Firstly, I reflected on my own personal change in circumstances and what it means for me and my family. Prior to getting married, my now husband and I redid our wills and reviewed all our personal insurance needs, as well as combined our investment portfolios. I was able to travel knowing that the kids and my parents are well provided for and that our affairs are largely in order. That feeling of peace of mind and the satisfaction of knowing that things were taken care of was reassuring and calming. I realised that I was very lucky to have my financial planner (who I have had for over 20 years) and was reminded of the deep value of good advice and planning. We were grateful that we were able to have the luxury holiday that we did – that was thanks to good planning and advice too.

My adviser’s promise of enriching my life and enabling me to live a life I love are starting to come true. Coincidentally, I know that this month the Fitzpatricia’s spent time sharing their Client Value Propositions with each other. I encourage you all to work on yours if you haven’t already.

It’s been a shorter working month for me, but while I was away, I know Marnie, Elaine and the coaches Paul and Terri, travelled the country, meeting with over 20 advisers in our community and facilitating “10-3-Now” conversations. I hope you found these conversations valuable and that they provided clarity and direction on your future pathway as we transition towards the National Firm. I know that some of these meetings were very powerful and moving, I was thrilled to hear that quite a few advisers took the opportunity to invite their partners to participate in these discussions. I hope it was a good reminder of the way we engage with clients differently and of the value of the Lead Adviser engagement process.

Since my update from last month, there has been significant work done on the National Firm Charter, and in particular on the National Firm Investment and Pricing Philosophy. Please take the time to read the valuable output of the working groups who contributed to these pieces of work.

Lastly, just a reminder that the CEO comms is the way we communicate all our important messages and updates that you need to be aware of. Please take the time to click through and read the updates from each of our teams in the different areas.

Farewell Nick Brinkworth

We would like to express our gratitude to Nick Brinkworth for his contribution to the Fitzpatricks Group over the last 6 years. Nick has brought both his strength and dedication to the business during his time with us and we wish him well for the future. Nick came on board to lead our Retirement Victoria business and then stepped into the FPW team, before his most recent role leading growth and partnering with our equity partners. In all these roles he has led with strong values and a passion for the success of this business. Nick’s last day in the [virtual] office will be Wednesday 31 May. All the best Nick. We have significantly benefited from your contribution and experience and we look forward to staying in touch.

Technical & Compliance

Outsourcing Policy

The revised Outsourcing policy has been refreshed and released here. Changes will impact:

• how you engage with prospective outsource providers;

• how you undertake due diligence to keep our clients information safe;

• how you document your review of any outsource service; and

• what you need to do before September 2023 if you have an arrangement for the outsource of services to a third party not included on the Approved Outsource Providers List.

Action Required:

• If you have an existing outsource arrangement with Padua, DBA or Tango, you do not need to take any further action. The structure of the outsource arrangement with VBP is different to others so if you have such an arrangement, please let us know so we can record their details.

• If you have an existing outsource arrangement and it is not included in the Approved Outsource Providers List (Professional Standards/Outsourcing Policy), please review the training material so you are able to meet your responsibilities within the required timeframes and contact Professional Standards if you have any questions.

Invoices for Clients who claim Tax Deductions for Financial Services

Since the introduction of Engagement Agreements, some advisers have become used to issuing these in place of invoices. As we draw close to the end of the financial year, it is timely to remember the place for invoices and their importance to the client.

Under the legislation, all entities are required to have a copy of a tax invoice for fees claimed as a tax deduction. This is particularly important for SMSFs or other businesses where the invoice must be produced within 28 days of the fee being charged to allow for correct accounting treatment within the fund. If the entity is unable to locate a tax invoice, the implications are:

• Entities may be unable to claim the GST for payments without a valid tax invoice

• If a service provider has not provided an ABN, the client must withhold tax from the payment at the top marginal tax rate

Where fees are charged to a platform, the platform may produce the tax invoice on your behalf. We are aware that HUB24 does and it is worthwhile to check other recommended platforms to confirm if they do as well. Where you have fees paid by direct debit, you will need to produce a tax invoice to allow the fund to treat the expense correctly. The easiest way to cover off this requirement is to produce your invoice at the time of your engagement agreement and consent, so all paperwork is dealt with at this earliest opportunity.

Associate Adviser

As you are aware, the use of ‘financial adviser’ and ‘financial planner’ are now restricted terms that are unable to be used unless the person described is authorised to provide personal financial advice. FPW uses the term of ‘Associate Adviser’ to describe a person who is authorised to provide financial advice but either chooses not to, or is in training to provide services for an FPW business (second chair). To avoid confusion for our clients, please do not appoint a staff member with this title unless you have cleared this use with Professional Standards.

Colin Lewis on leave

Just a reminder that Colin Lewis is on leave from Thursday, 25th May to Friday, 2nd June. Being out of the country, he will be unable to take any enquiries during this period.

Technology & Operations

Advice Technology Committee

We had our very first Advice Technology Committee meeting this month. The committee is made up of advisers, practice support staff, and FPW subject matter experts. The role of the committee is to represent the collective interests of our community by suggesting, assessing, and prioritising advice technology opportunities that ensure we focus our resources (people and budget) on the opportunities that deliver the most value. The committee also contributes to the design and rollout of prioritised opportunities to ensure they deliver the expected benefits. This approach enables us to continue delivering solutions that are ‘designed by advisers for advisers’.

You are invited to submit any advice technology related ideas you may have by clicking here. These ideas might relate to improvements to existing technology solutions, e.g. XPLAN, or new technologies.

The Advice Technology Committee will then assess and prioritise each idea based on expected effort/costs, benefits and impacts to practices. Prioritised ideas will then be scheduled based on available funding and capacity of relevant resources.

Please feel free to contact Siva Mehta should you have any further queries.

Managing your tasks with the new Xplan Task Hub

XPLAN Tasks help teams to keep on top of all the steps to deliver advice, service and manage clients and day to day operations. Knowing where things are at, what to do, who’s working on what, stopping things falling through the cracks, tying into your overall workflow and unlocking the power of automations in XPLAN. The recently released Task Hub builds on this, making it even more efficient and intuitive to create, manage and complete your tasks.

• Kanban board view to help users and teams visualise and manage the flow of work, making it simple to see current Tasks, the Task status, who the Task is assigned to and update it.

• A new link button available in the Task details enables quick navigation straight into entity record.

• Drag and Drop option to update Task status. Simply drag from column to column to update the Task status.

• Add Comments, update Checklists and add attachments by clicking into the Task on the board.

• It is simple to reassign Tasks by clicking on the assignee icon and selecting new assignee in your Team.

• Option to change the sort order to select preferred Task view by due date, priority, status, subject or task ID.

• Filter to view My Tasks or All Tasks in your Group. Task filters are available to narrow down and refine the tasks visible in Hub.

• When dragging and dropping into the completed column, if there are multiple task outcomes or the task has been configured to require a comment, checklist completion, time taken or forecasting the complete task modal will appear. If none of these requirements are met the task will complete – this is aligned with Xplans current behaviour.

Click on the new menu icon ![]() featured on the left and then select Tasks to access the new board.

featured on the left and then select Tasks to access the new board.

You can access the Task Hub Introduction Guide via the IRESS Community here.

Annual Review PWP template & guide

The Annual Review PWP template and guide has now been uploaded in the Xplan section of the Adviser Portal.

Final processing of payment tasks for 2022/23 FY

The last date for processing of Direct Debit and Credit Card payments for the financial year will be Friday 23rd June. If you wish to bring forward or add any Direct Debit and Credit Card payments please have tasks loaded in XPLAN by this date.

Pre-meeting Wizard

We have now built a Pre-meeting wizard in XPLAN which can be located under the FPW Process Wizards.

Investment

CFS Edge

On 14 March 2023, Colonial First State (CFS) launched CFS Edge, a new wealth platform. Designed to replace FirstWrap, financial advisers are welcome to access and write new business to the new platform.

• The FPW Investment Committee has approved the new CFS Edge platform and it has been added to the Approved Product List, and

• Negotiated a very competitive rate card for our authorised representatives – High Net Worth rate card (further details below)

CFS is working toward migrating all accounts on the FirstWrap platform to the new Edge platform within the next 12 months. Until migration, both platforms are open and available for you to place clients in.

To register with CFS or see a demonstration, speak to your local BDM, or click this link to request someone calls you.

Key features and benefits of CFS Edge

Developed by FNZ, the largest platform tech provider in the UK, CFS Edge combines state-of-the-art technology with a range of business services.

It creates a market leading proposition underpinned by a scalable operating model. FNZ is the largest platform tech provider in the UK with over $2 trillion in assets and 100,000 advisers globally. The transformation will deliver a significantly improved experience for advisers and their clients delivering improved outcomes for financial advisers and clients.

The new platform will deliver significant improvements for advisers and their clients, covering greater investment choice, tailored managed account solutions, a service experience that makes it easier to do business, enhanced advice technology integration and, data driven insights. CFS Edge is digital first, not digital only.

Below are some key benefits of the new CFS platform, Edge:

• Greater investment choice.

• Access to a complete suite of managed account solutions, retail & licensee SMAs, wholesale and model portfolio capability.

• Integration with a large number of advice technology solutions including Iress (XPLAN), Midwinter, Adviser Logic and Intelliflo.

• Data driven insights for advisers.

• Intuitive digital experience.

• Customisable desktop experience.

• Seamless asset transfer between different structures.

• Establishment preferences such as substitution and exclusion.

• Ability to apply ESG overlay preferences and filters to managed account portfolios.

• Ability to manage individual client investment needs and preferences.

• Detailed work tracker, click to chat functionality, interactive learning and

• support, call back request, streamlined authentication etc.

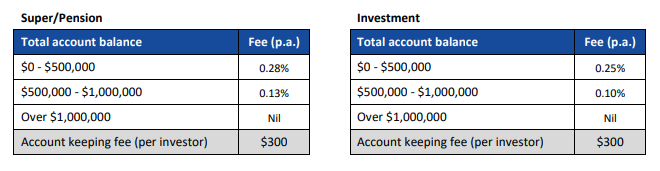

Rate Card

The competitive rate card available for FPW licensed advisers is below.

• The CFS Edge High Net Worth offer is outlined as per the following table:

HUB24 SMSF Access

HUB24 have launched a new service for SMSFs which is an extension of their IDPS offering and offers a low cost, streamlined SMSF solution. It is called ‘HUB24 SMSF Access’ and this has been approved by the FPW Investment Committee for clients that this service may be relevant for. Further details can be found here.

Business Coaching & Training

Business Continuity Plan

A friendly reminder, if you haven’t already started your Business Continuity Plan or need assistance, please contact [email protected] or [email protected].

We are striving towards having all Business Continuity Plans complete by 15 June 2023. Please refer to the Adviser Portal for more information on what a Business Continuity Plan is and why it is important for your clients, staff, business and family.

COCO

Thanks to those starting to connect, share and learn from the newly created COCO site located in teams. This is a fabulous way to bounce ideas off peers and ask those light bulk moment questions that come to mind during the day.

It is open to everyone. Please click here to check it out.

Adviser Summit

The Adviser Summit is a great opportunity to share with the wider market what Advisers are doing to future proof their business as well as step into the next level.

We are excited this year to have Jodie Blackledge and Gianna Thomson both presenting at this years Adviser Innovation Summit for 2023 and keep an eye out for Elaine OHagan at the Melbourne Summit, and Marnie Page at the Sydney Summit.

For more information, please click here.

Adviser Services

CPD Reminder

A total of 40 CPD Hours is required for completion, along with all Topic and Sub-Topics by 30 June 2023. It is important to note that it is the Adviser’s responsibility to monitor their progress to ensure they complete their required targets.

FPW Webinars

Please register to our upcoming FPW webinars:

| Date | Time | Topic/Presenter | Registration Link |

|---|---|---|---|

| Wednesday 25th October | 1:00pm QLD 2:00pmNSW/VIC/ACT 1:30pm SA 11:00am WA | Professional Standards | Register here |

Marketing

FPW Conference – Osaka Japan

We have a wonderful program planned for Japan, providing the opportunity to hear from international speakers. Our conference theme, Harmony in Collaboration, sets the scene with an opportunity to learn from a unique culture – Japan. The conference will provide an environment of collaboration and engagement. Learn different ways to engage with your clients to build trust-based relationships. If you are intending to join us in Japan, please register here as soon as possible.

Social Media

We use social media to promote our brand across communities. We promote our central value proposition, being how we enrich our clients’ lives. In addition, we use social media to promote our Lead Adviser approach to advice, setting us apart from broader advice models. More and more advisers are using social media to promote how they engage with clients and their community. Through social media we aim to promote the firm as professional and client-centric, and to highlight the value our advice provides in helping clients become “life sorted” and financially well organised. Marketing can assist you with key messages and the necessary tone to help you engage with centres of influence and clients. If you or a member of your practice would like to maximise the value of your social media, please reach out by emailing [email protected].