YOUR

ADVICE

PARTNER

We provide partnership opportunities to take you

and your practice to the next professional level.

We provide partnership opportunities to take you

and your practice to the next professional level.

Partnering with Fitzpatricks Private Wealth is an exclusive experience with multiple opportunities to help sustainably grow your business. Our unique Lead Adviser community and philosophy is underpinned by twenty years of success in a high net worth, client-centric, and fee for service business model. Download our Partnering Together Overview to learn more about the Fitzpatricks Partnership Community pathways we have created for the elite Lead Adviser network.

A Lead Adviser, family CFO style, philosophy of advice

Sustainable growth and community mindset

Private ownership – by advisers for advisers

Elevating the advice profession with ethical and ‘best of breed’ capabilities

Coaching and Mentoring

Intellectual Property Sharing

Strong Peer Network

In this video our Group CEO Jodie Blackledge and Co-Founders Scott Fitzpatrick and John Woodley discuss what’s at the heart of our company.

DOWNLOAD YOUR ADVICE PARTNER

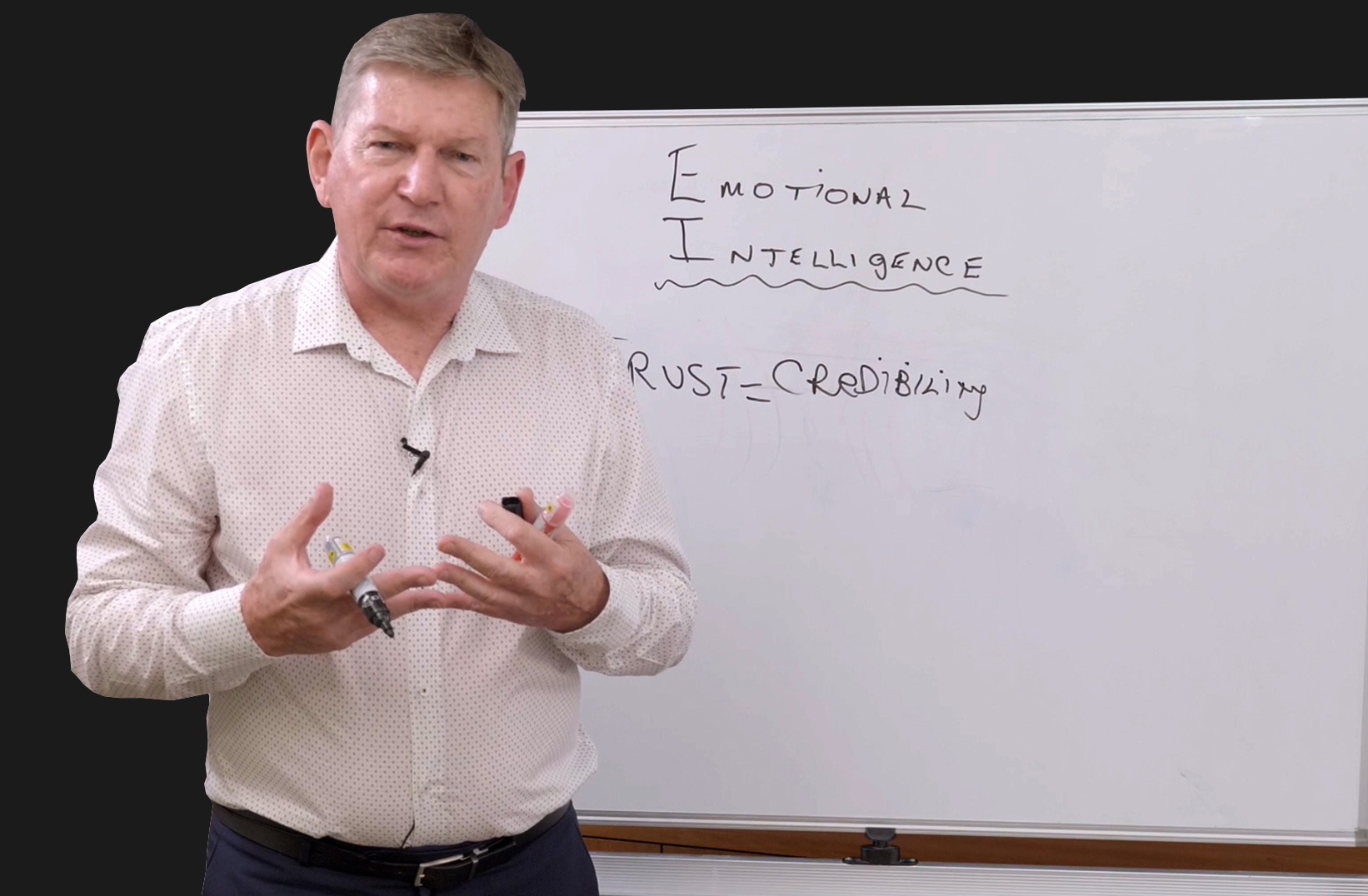

We’ve been walking the talk for over 20 years with our Lead Adviser coaching program. Combining technical skills with deep emotional intelligence you can learn how to be a true financial partner to your valuable high net worth clients.

“While I have always known absolutely that it’s about clients’ goals and objectives and enabling them to have a better life that they want, I don’t think I’ve ever had the right tools and the right connections, and the right belief systems on how to actually implement that. The Lead Adviser course has definitely given me what I have been searching for”

“To be able to master emotional intelligence, we think is one of the key ingredients to great advice and is a real focus point for us”

“For advisers there’s a lot of noise in the industry, and as we merge into a profession this course will give you an insight into what your business and future could look like”

Have our partnership consultant, Anthony Vaiente, contact you directly about the range of opportunities to connect with Fitzpatricks Private Wealth.