Greece now China?

Further to our recent correspondence on Greece and given the additional sharp rise in volatility of the Chinese markets, we thought you might appreciate the following update on the current situation in both countries.

Greece

- As previously outlined, the situation in Greece remains fluid, with much uncertainty about the potential for Greece to remain within the Eurozone. The “No” vote at the referendum last weekend was not expected by markets, although the impact on markets has been less than what might have been expected ahead of the vote.

- Greece is technically in default of its obligations to the IMF and it seems inevitable that creditors will not be repaid in full. The Greek banking sector is wholly dependent on the ECB to avoid collapse, and the banks will not open until after this weekend’s summit – seemingly the final, final deadline for Greece.

- Whilst it is impossible to predict the outcome, our base view is that an agreement will be reached which allows Greece to remain in the Eurozone, albeit with major concessions by both sides.

- While this is a base case, we need to monitor the situation as there is also a reasonable chance that Greece may be forced to leave the Eurozone.

- However, we are more confident that the ECB, IMF and EU have prepared well for the potential of an exit and will have tools at their disposal and a well-articulated plan for how this could be executed.

China

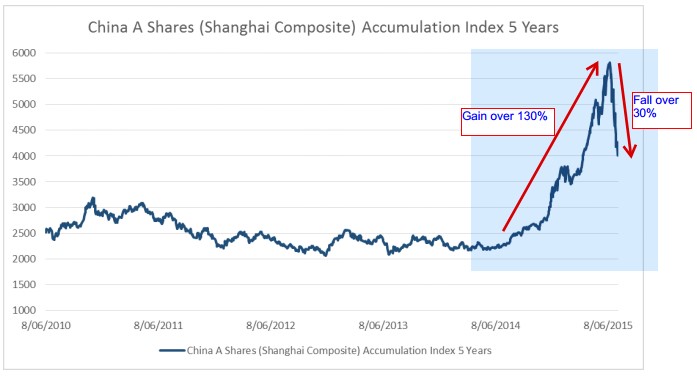

- The Chinese share market has fallen more than 30% over the past few weeks.

Source: Bloomberg

- At present, there is a significant amount of volatility in the daily price action – with rises and falls of many individual stocks of up to 10% on a daily basis.

- What needs to be remembered is that the Chinese share market had risen around 130% over a 12-month period – so a correction of some magnitude was increasingly likely.

- The actions of the Chinese government to stem the losses (there have been instructions that state owned enterprises are to cease selling any equities, state pensions and insurance companies have seen changes to regulations which will likely see them forced / permitted to increase equity exposures, all IPO’s in the pipeline have been cancelled, and more than 40% of listed companies are currently suspended from trading) have been largely ineffective to date as prices have continued to slide.

- It is likely that the Chinese government will continue to act to ensure the stability of their financial system. We would expect further measures of this kind.

- While we view the situation as largely isolated to China, there are obvious implications for consumer and business sentiment in general and broader flow-on effects to the Chinese economy. Commodity prices have also seen large falls over recent days – albeit this should mostly surround the Iron Ore price.

With Greece and China gaining constant media attention, we feel it is important to remind our investors that we have no direct exposure to the Greek and Chinese share markets. Any indirect exposure through our global managers is extremely small and being actively managed. Furthermore, given the diversity of our investments, it is also important to remember that we expect other parts of our portfolio should prosper from this situation.

The flow-on effects to the financial system and broader global economy remain as key areas of focus. As usual, we are prepared and ready to act should the situation deteriorate.