Updates

Dear FPW Adviser Community,

As we head into spring and hopefully warmer weather, I feel a sense of excitement brewing from those of you attending the conference in Japan. With less than four weeks to go, we are working with our conference committee on the final touches to the agenda. For those of you attending conference, it will be an opportunity for you to work on your “future” business as opposed to working in your business, with plenty of time to pause and reflect.

The conference will focus on the themes of harmony and collaboration, so that we can continue to build strong relationships, mutual trust, and open communication in our community. It will be an opportunity to further explore the National Firm strategy, and to understand what partnership will look like and what we can learn from each other. In essence, it is the National Firm’s inaugural partners meeting. The place where we get to experiment with what the future will look like – our preconceived judgements and understanding should give way to curiosity and creativity.

As well as all that, it will be fun! I look forward to spending time with you and your families in the land of the rising sun.

This month we welcomed our new Group Head of Marketing, Fraser Thomson to the Fitzpatricks team. We are delighted to have Fraser onboard, as we continue to execute our strategy. We look forward to his insights and expertise to assist us on this journey.

As always please feel free to reach out or to add your comments to COCO, our community chat forum.

ADVISER COMMUNITY NEWS

This month we delve a little deeper into the life of one of our very special Senior Advisers. David Cuff is a Senior Adviser with FTZ Advice Partnership, based in the Sydney office.

Q: How long have you been at FTZ Advice Partnership Pty Ltd?

A: I started in June 2020, now 3 years in and loving it.

Q: Why did you enter the financial services industry and how long ago?

A: My story is an inspiring one. My cousin became a quadriplegic in a serious sporting accident during his early 30’s. My father was helping him navigate through the health system when he received a payout, understanding whom to seek professional advice from through a stressful time, gave me my very first exposure to Advice. This actually happened whilst I was at University and at the time, I didn’t see myself in a client facing role. Looking back at this experience and how my father was able to help my cousin get through, gave me a new pathway which I thought was worth exploring.

Q: What has been your best life experience so far?

A: “Being a Dad”, he says whilst trying to find me a photo of the boys… Lennox (3) and Lincoln (2).

Q: What do you want to do when you grow up?

A: Good question?? Probably something to do with the ocean. A lifeguard or scuba dive instructor would be a great lifestyle. Something pretty relaxed!! As you can see from the photo, something that involves swimming everyday would be awesome.

Q: When have you felt you have enriched a clients life?

A: Well, I hope that we do this every day for our clients. It is really good when you get feedback from clients about something that’s been a worry or concern for them, that you’ve actually helped take that weight off their shoulders. It could be big or small to us, but big for the clients. Hearing it from them and seeing that they have peace of mind is really rewarding.

Q: What’s your 10/3/Now?

A: If we talk about the journey over 10 years, its really discovering where we want to live as a family, establishing our “roots” and growing together.

Technical & Compliance

Policy refresh

We have been busy reviewing the current suite of policies in line with our review schedule and have made changes to several policies.

Cyber Security

Even though many of you will have completed your Business Continuity Plan, we have modified the policy to make this a mandatory requirement. This policy position recognises the critical importance of each of us having plans and controls in place in case of a disaster. This is one easy way to build resilience and allows us to meet our responsibilities to our clients.

Types of Clients

This policy has simply had a tidy up. We have clarified that you can use a certified copy of a Power of Attorney and to help reduce confusion as to who can certify documents, we have added a Guide to Who Can Certify Documents.

Digital Signatures

We have refreshed this policy clarifying the need to secure documents if being sent by email.

Approved Product List

This policy has been refreshed and reformatted to align with other policy documents.

Software and Outsource Provider APL

We have combined the Approved Outsource Provider List with the list of Approved software to make one consolidated list for ease of reference.

Outsourcing reminder

Our outsourcing policy asks that all arrangements that are not covered by the Software and Outsource Provider APL are due to be submitted for review and approval by 1st September. If you use outsource providers to prepare paraplanning, complete admin tasks or you use software that has not been included in the approved list, please reach out to Professional Standards asap.

AFCA Decisions and goals

In a number of recent decisions, AFCA have highlighted the importance of having good goals. Good goals are described as being goals that align with what the client would express to you as their adviser, or perhaps to a trusted friend, in terms of what they would like to achieve through obtaining financial advice. Whilst good is not further defined, AFCA has stated that where goals are confused with strategies and methods of achieving the goals, these will not be adequate of themselves to show best interest. The following were considered to be methodologies for achieving the goals and not goals themselves:

• Retaining strategies available via particular products

• Having superannuation benefits actively managed by specialists

• Improving diversification

• Investing cost effectively and in line with the risk profile

The fact-finding process is critical to clients being able to provide their own goals. Goals that AFCA believe to be limited or generic, include:

• You want to invest in line with your risk profile

• You want your investment portfolio to be constructed and managed by your financial adviser

• You want to retain access to the funds

• You want a diversified portfolio that is cost effective yet has the potential to outperform its benchmark.

For more information, please see this article.

Technology & Operations

Got a good technology idea?

Go ahead and submit your good advice technology ideas here. Your idea might be an improvement to our existing technology solutions, e.g., XPLAN, or exploring new technologies. Your idea will then be assessed by the Advice Technology Committee – a representative group of your peers who work with the FPW team to prioritise, design, test, and support the rollout of advice technology opportunities.

Online Fact Find going live

It was great to see everyone at last week’s webinar to launch the new Online Fact Find via the Xplan Client Portal that will be released on Monday 4 September. As a reminder, this is a solution that was prioritised by the Advice Technology Committee. Thank you to everyone involved. Click here for a recording of last week’s webinar in case you missed it.

Execution Only Service Wizard going live

The purpose of this wizard – again prioritised, designed and tested by the Advice Technology Committee – is to provide efficiencies when instructions are provided by a client for an Execution Only transaction. We are in the final stages of testing this new wizard. Subject to any issues identified, the new wizard will be released on Monday 4 September.

Improvements to Xplan Client menu are coming

We’re making improvements to the client menu in XPLANto make it more intuitive and streamlined. We expect to release the improvements on Monday 4 September. Click here for a preview of the new menu.

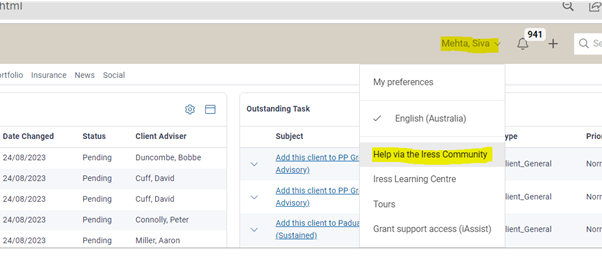

Keep up to date with XPLAN news and changes

The Iress Community allows you to subscribe to content that you find useful or interesting and wish to follow for any updates or changes.

How to register to the Iress Community:

Click on your name at the top of the Xplan screen and then click on Help via the Iress Community. This will launch the Iress Community. Click Register at the top of the screen and follow the prompts.

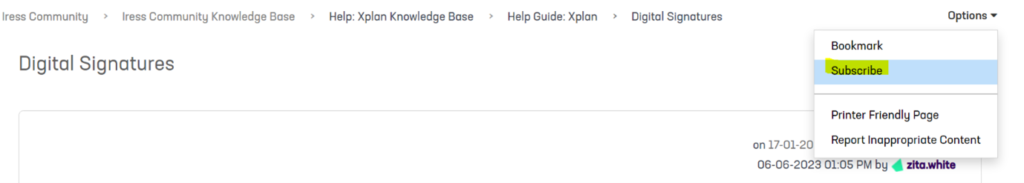

How to subscribe to a space or article:

Within the relevant space, select Options on the top right and click Subscribe. You can also unsubscribe via the same method.

Alternatively, you can manage your subscriptions in bulk by clicking on your profile picture and selecting My Subscriptions.

You can also click on your profile picture and select My Settings to ensure you see the email updates you want to see. For example, if you want to see all replies to Service Updates, you need to check that ‘For my forum subscriptions, notify me for’ is set to ‘Use default (All posts)’.

Click here for my information on how to subscribe to useful content for notifications by email.

Investment

Risk Profiling Material

There are new versions of the Risk Profiling material following minor updates to charts and figures. Lonsec recently made minor updates to their long term capital market assumptions for various asset classes and these have been reflected in the Risk Profiling Workbook, guide for clients and presentation (available on the Adviser Portal here). Additionally the changes have been reflected in the adviser guide, Asset Allocation and Return Forecasts.

Business Coaching & Training

Adviser & Technical Days – Save the date

The Adviser Day is creeping up this year, and we would be delighted to have you join us again as we continue on our journey to building out the National Firm.

Everyone plays a pivotal role in shaping the future and guiding individuals towards success with your knowledge and skills so please mark in your calendars the following dates and over the coming weeks you will receive a registration link and Agenda items.

- 11 October – Virtual Technical Day

- 27 November – Adviser Day Brisbane

- 29 November – Adviser Day, Sydney

- 5 December – Adviser Day, Perth

Business Continuity Plans

Thank you to everyone for completing your Business Continuity Plan.

Remember, the BCP is not a one-time document but a living document that should be periodically reviewed and updated to reflect changes in your operations, processes or external environment, we are pleased to share that we will incorporate a review of the Business Continuity Plan into our annual business planning process and it will form part of our Policy suit going forward.

Please include a review of your BCP at minimum annually, or whenever a new starter commences with your practice. As important is ensuring your teams are comfortable with your disaster recovery plan and the practical steps to take should you experience a disaster in your business or environment.

COCO

Looking for an efficient way to share ideas and collaborate with your fellow advisers? Look no further than “COCO” This powerful central connection and sharing tool on Teams will transform the way you work, allowing you to easily share information, files and, track progress whilst staying connected with the community.

Say goodbye to scattered emails and missed messages, and hello to a more productive, collaborative work space with COCO.

Adviser Services

FPW Webinars

Please register to ensure you have a placeholder for our upcoming FPW webinars. A reminder CPD is assessed for all FPW webinars. If a webinar is deemed eligible, CPD points will automatically be added to Authorised Representatives of our Licensees who have attended 80% of the session.

| Date | Time | Topic/Presenter | Registration Link |

|---|---|---|---|

| Wednesday 25th October | 1:00pm QLD 2:00pmNSW/VIC/ACT 1:30pm SA 11:00am WA | Professional Standards | Register here |

Marketing

Looking forwards

I am delighted to have been appointed the Group Head of Marketing for Fitzpatricks. From my previous experience at ANZ, IAM and FIIG, I have a wealth of experience in both financial advice and investment management that will help me to lead and inspire our marketing efforts.

As we transition to the new operating model and the creation of the National Firm it is a very exciting time to be joining Fitzpatricks. Marketing will play a critical role in this next chapter of our strategic vision, I look forward to meeting you over the coming months and to start building the National Firms new brand, identity and marketing collateral that will help to support the ongoing growth of Fitzpatricks.

PREVIOUS MONTH IN REVIEW

Growth Masterclass: Pricing Principles

Here is a quick recap of the Growth Masterclass communication sent last month.

Following the success of the first Growth Masterclass on Pricing Principles led by John Woodley, a follow-up email was sent with additional resources, including:

– video from Garry discussing how he approaches client meetings

– video from Jasia discussing the value of advice from a client’s perspective

– video from Terri providing a coach’s perspective on the value of advice

– video from Leonard providing a practitioner’s perspective of the value of advice

If you would like to access this content, the email and links can be viewed here.